Google just dropped a bombshell: Eric Schmidt is out as CEO (as announced in the company’s earings report. We’ll be covering the company’s earnings call, which is sure to have more on this.

He will step down from the role starting April 4, and co-founder Larry Page will take charge of Google’s day-to-day operations as CEO. Co-founder Sergey Brin will devote his energy to strategic projects like working on new products.

Schmidt will assume the role of Executive Chairman, focusing externally on deals, partnerships, customers and broader business relationships, government outreach and technology thought leadership–all of which are increasingly important given Google’s global reach. Internally, he will continue to act as an advisor to Larry and Sergey.

Update: More from the call. And more here.

Schmidt tweeted the following a few minutes ago:

On the Official Google Blog, Schmidt writes:

When I joined Google in 2001 I never imagined—even in my wildest dreams—that we would get as far, as fast as we have today. Search has quite literally changed people’s lives—increasing the collective sum of the world’s knowledge and revolutionizing advertising in the process. And our emerging businesses—display, Android, YouTube and Chrome—are on fire. Of course, like any successful organization we’ve had our fair share of good luck, but the entire team—now over 24,000 Googlers globally—deserves most of the credit.

And as our results today show, the outlook is bright. But as Google has grown, managing the business has become more complicated. So Larry, Sergey and I have been talking for a long time about how best to simplify our management structure and speed up decision making—and over the holidays we decided now was the right moment to make some changes to the way we are structured.

For the last 10 years, we have all been equally involved in making decisions. This triumvirate approach has real benefits in terms of shared wisdom, and we will continue to discuss the big decisions among the three of us. But we have also agreed to clarify our individual roles so there’s clear responsibility and accountability at the top of the company.

Larry will now lead product development and technology strategy, his greatest strengths, and starting from April 4 he will take charge of our day-to-day operations as Google’s Chief Executive Officer. In this new role I know he will merge Google’s technology and business vision brilliantly. I am enormously proud of my last decade as CEO, and I am certain that the next 10 years under Larry will be even better! Larry, in my clear opinion, is ready to lead.

Sergey has decided to devote his time and energy to strategic projects, in particular working on new products. His title will be Co-Founder. He’s an innovator and entrepreneur to the core, and this role suits him perfectly.

As Executive Chairman, I will focus wherever I can add the greatest value: externally, on the deals, partnerships, customers and broader business relationships, government outreach and technology thought leadership that are increasingly important given Google’s global reach; and internally as an advisor to Larry and Sergey.

We are confident that this focus will serve Google and our users well in the future. Larry, Sergey and I have worked exceptionally closely together for over a decade—and we anticipate working together for a long time to come. As friends, co-workers and computer scientists we have a lot in common, most important of all a profound belief in the potential for technology to make the world a better place. We love Google—our people, our products and most of all the opportunity we have to improve the lives of millions of people around the world.

Earlier Schmidt wrote an ineresting post at Harvard Business Review today indicating that Google’s strategic initiatives for the year are all about mobile. He wrote:

First, we must focus on developing the underlying fast networks (generally called LTE). These will be 8-to-10- megabit networks, roughly 10 times what we have today, which will usher in new and creative applications, mostly entertainment and social, for these phone platforms.

Second, we must attend to the development of mobile money. Phones, as we know, are used as banks in many poorer parts of the world—and modern technology means that their use as financial tools can go much further than that.

Third, we want to increase the availability of inexpensive smartphones in the poorest parts of the world. We envision literally a billion people getting inexpensive, browser-based touchscreen phones over the next few years. Can you imagine how this will change their awareness of local and global information and their notion of education? And that will be just the start.

Here’s the full release including the financials (see the balance sheets here):

MOUNTAIN VIEW, Calif. – January 20, 2011 – Google Inc. (NASDAQ: GOOG) today announced financial results for the quarter and the fiscal year ended December 31, 2010.

"Q4 marked a terrific end to a stellar year," said Eric Schmidt, CEO of Google. "Our strong performance has been driven by a rapidly growing digital economy, continuous product innovation that benefits both users and advertisers, and by the extraordinary momentum of our newer businesses, such as display and mobile. These results give us the optimism and confidence to invest heavily in future growth — investments that will benefit our users, Google and the wider web."

In addition, Google has also announced plans to streamline decision making and create clearer lines of responsibility and accountability at the top of the company.

- Starting from April 4, Larry Page, Google Co-Founder, will take charge of Google’s day-to-day operations as Chief Executive Officer.

- Sergey Brin, Google Co-Founder, will devote his energy to strategic projects, in particular working on new products.

- Eric Schmidt will assume the role of Executive Chairman, focusing externally on deals, partnerships, customers and broader business relationships, government outreach and technology thought leadership–all of which are increasingly important given Google’s global reach. Internally, he will continue to act as an advisor to Larry and Sergey.

Commenting on these changes, Eric said: "We’ve been talking about how best to simplify our management structure and speed up decision making for a long time. By clarifying our individual roles we’ll create clearer responsibility and accountability at the top of the company. In my clear opinion, Larry is ready to lead and I’m excited about working with both him and Sergey for a long time to come."

Larry said: "Eric has clearly done an outstanding job leading Google for the last decade. The results speak for themselves. There is no other CEO in the world that could have kept such headstrong founders so deeply involved and still run the business so brilliantly. Eric is a tremendous leader and I have learned innumerable lessons from him. His advice and efforts will be invaluable to me as I start in this new role. Google still has such incredible opportunity–we are only at the beginning and I can’t wait to get started."

Q4 Financial Summary

Google reported revenues of $8.44 billion for the quarter ended December 31, 2010, an increase of 26% compared to the fourth quarter of 2009. Google reports its revenues, consistent with GAAP, on a gross basis without deducting traffic acquisition costs (TAC). In the fourth quarter of 2010, TAC totaled $2.07 billion, or 25% of advertising revenues.

Google reports operating income, operating margin, net income, and earnings per share (EPS) on a GAAP and non-GAAP basis. The non-GAAP measures, as well as free cash flow, an alternative non-GAAP measure of liquidity, are described below and are reconciled to the corresponding GAAP measures in the accompanying financial tables.

- GAAP operating income in the fourth quarter of 2010 was $2.98 billion, or 35% of revenues. This compares to GAAP operating income of $2.48 billion, or 37% of revenues, in the fourth quarter of 2009. Non-GAAP operating income in the fourth quarter of 2010 was $3.38 billion, or 40% of revenues. This compares to non-GAAP operating income of $2.76 billion, or 41% of revenues, in the fourth quarter of 2009.

- GAAP net income in the fourth quarter of 2010 was $2.54 billion, compared to $1.97 billion in the fourth quarter of 2009. Non-GAAP net income in the fourth quarter of 2010 was $2.85 billion, compared to $2.19 billion in the fourth quarter of 2009.

- GAAP EPS in the fourth quarter of 2010 was $7.81 on 326 million diluted shares outstanding, compared to $6.13 in the fourth quarter of 2009 on 322 million diluted shares outstanding. Non-GAAP EPS in the fourth quarter of 2010 was $8.75, compared to $6.79 in the fourth quarter of 2009.

- Non-GAAP operating income and non-GAAP operating margin exclude the expenses related to stock-based compensation (SBC). Non-GAAP net income and non-GAAP EPS exclude the expenses related to SBC and the related tax benefits. In the fourth quarter of 2010, the charge related to SBC was $396 million, compared to $276 million in the fourth quarter of 2009. The tax benefit related to SBC was $89 million in the fourth quarter of 2010 and $62 million in the fourth quarter of 2009.

Q4 Financial Highlights

Revenues – Google reported revenues of $8.44 billion in the fourth quarter of 2010, representing a 26% increase over fourth quarter 2009 revenues of $6.67 billion. Google reports its revenues, consistent with GAAP, on a gross basis without deducting TAC.

Google Sites Revenues – Google-owned sites generated revenues of $5.67 billion, or 67% of total revenues, in the fourth quarter of 2010. This represents a 28% increase over fourth quarter 2009 revenues of $4.42 billion.

Google Network Revenues – Google’s partner sites generated revenues, through AdSense programs, of $2.50 billion, or 30% of total revenues, in the fourth quarter of 2010. This represents a 22% increase from fourth quarter 2009 network revenues of $2.04 billion.

International Revenues – Revenues from outside of the United States totaled $4.38 billion, representing 52% of total revenues in the fourth quarter of 2010, compared to 52% in the third quarter of 2010 and 53% in the fourth quarter of 2009. Excluding gains related to our foreign exchange risk management program, had foreign exchange rates remained constant from the third quarter of 2010 through the fourth quarter of 2010, our revenues in the fourth quarter of 2010 would have been $201 million lower. Excluding gains related to our foreign exchange risk management program, had foreign exchange rates remained constant from the fourth quarter of 2009 through the fourth quarter of 2010, our revenues in the fourth quarter of 2010 would have been $132 million higher.

- Revenues from the United Kingdom totaled $878 million, representing 10% of revenues in the fourth quarter of 2010, compared to 12% in the fourth quarter of 2009.

- In the fourth quarter of 2010, we recognized a benefit of $25 million to revenues through our foreign exchange risk management program, compared to $8 million in the fourth quarter of 2009.

Paid Clicks – Aggregate paid clicks, which include clicks related to ads served on Google sites and the sites of our AdSense partners, increased approximately 18% over the fourth quarter of 2009 and increased approximately 11% over the third quarter of 2010.

Cost-Per-Click – Average cost-per-click, which includes clicks related to ads served on Google sites and the sites of our AdSense partners, increased approximately 5% over the fourth quarter of 2009 and increased approximately 4% over the third quarter of 2010.

TAC – Traffic Acquisition Costs, the portion of revenues shared with Google’s partners, increased to $2.07 billion in the fourth quarter of 2010, compared to TAC of $1.72 billion in the fourth quarter of 2009. TAC as a percentage of advertising revenues was 25% in the fourth quarter of 2010, compared to 27% in the fourth quarter of 2009.

The majority of TAC is related to amounts ultimately paid to our AdSense partners, which totaled $1.74 billion in the fourth quarter of 2010. TAC also includes amounts ultimately paid to certain distribution partners and others who direct traffic to our website, which totaled $333 million in the fourth quarter of 2010.

Other Cost of Revenues – Other cost of revenues, which is comprised primarily of data center operational expenses, amortization of intangible assets, content acquisition costs as well as credit card processing charges, increased to $877 million, or 10% of revenues, in the fourth quarter of 2010, compared to $688 million, or 10% of revenues, in the fourth quarter of 2009.

Operating Expenses – Operating expenses, other than cost of revenues, were $2.51 billion in the fourth quarter of 2010, or 30% of revenues, compared to $1.78 billion in the fourth quarter of 2009, or 27% of revenues.

Stock-Based Compensation (SBC) – In the fourth quarter of 2010, the total charge related to SBC was $396 million, compared to $276 million in the fourth quarter of 2009.

We currently estimate SBC charges for grants to employees prior to January 1, 2011 to be approximately $1.6 billion for 2011. This estimate does not include expenses to be recognized related to employee stock awards that are granted after December 31, 2010 or non-employee stock awards that have been or may be granted.

Operating Income – GAAP operating income in the fourth quarter of 2010 was $2.98 billion, or 35% of revenues. This compares to GAAP operating income of $2.48 billion, or 37% of revenues, in the fourth quarter of 2009. Non-GAAP operating income in the fourth quarter of 2010 was $3.38 billion, or 40% of revenues. This compares to non-GAAP operating income of $2.76 billion, or 41% of revenues, in the fourth quarter of 2009.

Interest and Other Income, Net – Interest and other income, net increased to $160 million in the fourth quarter of 2010, compared to $88 million in the fourth quarter of 2009.

Income Taxes – Our effective tax rate was 19% for the fourth quarter of 2010.

Net Income – GAAP net income in the fourth quarter of 2010 was $2.54 billion, compared to $1.97 billion in the fourth quarter of 2009. Non-GAAP net income was $2.85 billion in the fourth quarter of 2010, compared to $2.19 billion in the fourth quarter of 2009. GAAP EPS in the fourth quarter of 2010 was $7.81 on 326 million diluted shares outstanding, compared to $6.13 in the fourth quarter of 2009 on 322 million diluted shares outstanding. Non-GAAP EPS in the fourth quarter of 2010 was $8.75, compared to $6.79 in the fourth quarter of 2009.

Cash Flow and Capital Expenditures – Net cash provided by operating activities in the fourth quarter of 2010 totaled $3.53 billion, compared to $2.73 billion in the fourth quarter of 2009. In the fourth quarter of 2010, capital expenditures were $2.55 billion, which was primarily related to the purchase of our office building in New York City, as well as IT infrastructure investments, including data centers, servers, and networking equipment. Free cash flow, an alternative non-GAAP measure of liquidity, is defined as net cash provided by operating activities less capital expenditures. In the fourth quarter of 2010, free cash flow was $981 million.

We expect to continue to make significant capital expenditures.

A reconciliation of free cash flow to net cash provided by operating activities, the GAAP measure of liquidity, is included at the end of this release.

Cash – As of December 31, 2010, cash, cash equivalents, and marketable securities were $35.0 billion.

Headcount – On a worldwide basis, Google employed 24,400 full-time employees as of December 31, 2010, up from 23,331 full-time employees as of September 30, 2010.

WEBCAST AND CONFERENCE CALL INFORMATION

A live audio webcast of Google’s fourth quarter and fiscal year 2010 earnings release call will be available at http://investor.google.com/webcast.html. The call begins today at 1:30 PM (PT) / 4:30 PM (ET). This press release, the financial tables, as well as other supplemental information including the reconciliations of certain non-GAAP measures to their nearest comparable GAAP measures, are also available on that site.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements that involve risks and uncertainties. These statements include statements regarding our continued investments in our core areas of strategic focus, our expected stock-based compensation charges, and our plans to make significant capital expenditures. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, unforeseen changes in our hiring patterns and our need to expend capital to accommodate the growth of the business, as well as those risks and uncertainties included under the captions "Risk Factors" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the year ended December 31, 2009, and our most recent Quarterly Report on Form 10-Q for the quarter ended September 30, 2010, which are on file with the SEC, and are available on our investor relations website at investor.google.com and on the SEC website at www.sec.gov. Additional information will also be set forth in our Annual Report on Form 10-K for the year ended December 31, 2010, which we expect to file with the SEC in February 2011. All information provided in this release and in the attachments is as of January 20, 2011, and Google undertakes no duty to update this information.

ABOUT NON-GAAP FINANCIAL MEASURES

To supplement our consolidated financial statements, which statements are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: non-GAAP operating income, non-GAAP operating margin, non-GAAP net income, non-GAAP EPS, and free cash flow. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. For more information on these non-GAAP financial measures, please see the tables captioned "Reconciliations of non-GAAP results of operations measures to the nearest comparable GAAP measures" and "Reconciliation from net cash provided by operating activities to free cash flow" included at the end of this release.

We use these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. Our management believes that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain expenses and expenditures that may not be indicative of our "recurring core business operating results," meaning our operating performance excluding not only non-cash charges, such as stock-based compensation, but also discrete cash charges that are infrequent in nature. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to our historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business.

Non-GAAP operating income and operating margin. We define non-GAAP operating income as operating income plus stock-based compensation. Non-GAAP operating margin is defined as non-GAAP operating income divided by revenues. Google considers these non-GAAP financial measures to be useful metrics for management and investors because they exclude the effect of stock-based compensation so that Google’s management and investors can compare Google’s recurring core business operating results over multiple periods. Because of varying available valuation methodologies, subjective assumptions and the variety of award types that companies can use under ASC Topic 718, Google’s management believes that providing a non-GAAP financial measure that excludes stock-based compensation allows investors to make meaningful comparisons between Google’s recurring core business operating results and those of other companies, as well as providing Google’s management with an important tool for financial and operational decision making and for evaluating Google’s own recurring core business operating results over different periods of time. There are a number of limitations related to the use of non-GAAP operating income versus operating income calculated in accordance with GAAP. First, non-GAAP operating income excludes some costs, namely, stock-based compensation, that are recurring. Stock-based compensation has been and will continue to be for the foreseeable future a significant recurring expense in Google’s business. Second, stock-based compensation is an important part of our employees’ compensation and impacts their performance. Third, the components of the costs that we exclude in our calculation of non-GAAP operating income may differ from the components that our peer companies exclude when they report their results of operations. Management compensates for these limitations by providing specific information regarding the GAAP amounts excluded from non-GAAP operating income and evaluating non-GAAP operating income together with operating income calculated in accordance with GAAP.

Non-GAAP net income and EPS. We define non-GAAP net income as net income plus stock-based compensation less the related tax effects. We define non-GAAP EPS as non-GAAP net income divided by the weighted average outstanding shares, on a fully-diluted basis. We consider these non-GAAP financial measures to be a useful metric for management and investors for the same reasons that Google uses non-GAAP operating income and non-GAAP operating margin. However, in order to provide a complete picture of our recurring core business operating results, we exclude from non-GAAP net income and non-GAAP EPS the tax effects associated with stock-based compensation. Without excluding these tax effects, investors would only see the gross effect that excluding these expenses had on our operating results. The same limitations described above regarding Google’s use of non-GAAP operating income and non-GAAP operating margin apply to our use of non-GAAP net income and non-GAAP EPS. Management compensates for these limitations by providing specific information regarding the GAAP amounts excluded from non-GAAP net income and non-GAAP EPS and evaluating non-GAAP net income and non-GAAP EPS together with net income and EPS calculated in accordance with GAAP.

Free cash flow. We define free cash flow as net cash provided by operating activities minus capital expenditures. We consider free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that, after the acquisition of property and equipment, including information technology infrastructure and land and buildings, can be used for strategic opportunities, including investing in our business, making strategic acquisitions, and strengthening the balance sheet. Analysis of free cash flow also facilitates management’s comparisons of our operating results to competitors’ operating results. A limitation of using free cash flow versus the GAAP measure of net cash provided by operating activities as a means for evaluating Google is that free cash flow does not represent the total increase or decrease in the cash balance from operations for the period because it excludes cash used for capital expenditures during the period. Our management compensates for this limitation by providing information about our capital expenditures on the face of the cash flow statement and under the caption "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in our Quarterly Report on Form 10-Q and Annual Report on Form 10-K. Google has computed free cash flow using the same consistent method from quarter to quarter and year to year.

The accompanying tables have more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related reconciliations between these financial measures.

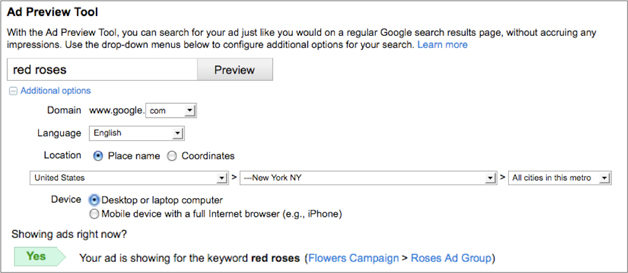

Mr. Fox acknowledged there are "edge" cases in which search queries "does not appear to be relevant to the ads, but the context of previous queries indicated that the user would have a strong interest in that advertisers’ ad." In addition, he said, "a user must be interested enough in an ad to want to click on it." He said a very small percentage of ad clicks are session-based and that advertisers can limit the scope of their campaign to halt session-based clicks.

Mr. Fox acknowledged there are "edge" cases in which search queries "does not appear to be relevant to the ads, but the context of previous queries indicated that the user would have a strong interest in that advertisers’ ad." In addition, he said, "a user must be interested enough in an ad to want to click on it." He said a very small percentage of ad clicks are session-based and that advertisers can limit the scope of their campaign to halt session-based clicks.

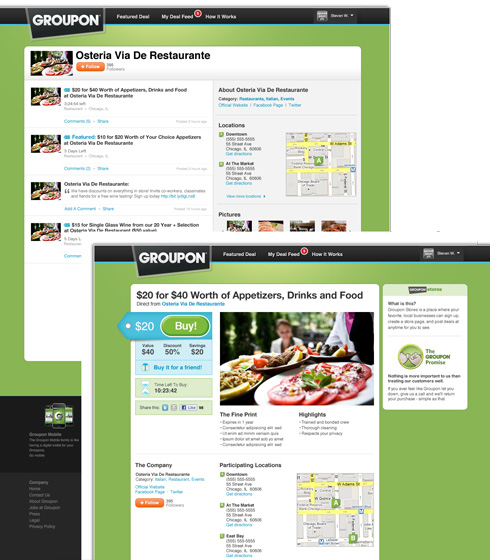

Groupon said they had no commercial interest in misleading their customers; if an offer was poorly described on their website, that detrimentally affected their relationship with customers and business partners, undermining the investment they made in acquiring both. Further, in presenting in excess of 50 deals per day, there was a likelihood of some degree of human error. However, they sought to address that through extensive staff training and by incorporating quality control safeguards. (

Groupon said they had no commercial interest in misleading their customers; if an offer was poorly described on their website, that detrimentally affected their relationship with customers and business partners, undermining the investment they made in acquiring both. Further, in presenting in excess of 50 deals per day, there was a likelihood of some degree of human error. However, they sought to address that through extensive staff training and by incorporating quality control safeguards. (

“We’re pleased that our technology will benefit Myspace’s users on its newly redesigned site, and that Myspace has chosen our display advertising solution to increase its returns.”

“We’re pleased that our technology will benefit Myspace’s users on its newly redesigned site, and that Myspace has chosen our display advertising solution to increase its returns.”  "Pictela is an outstanding fit for AOL as we re-imagine the intersection of content, advertising and the consumer experience," said Jeff Levick, AOL’s President of Global Advertising and Strategy. "Pictela’s product development team is best-in-class, and its beautiful, content rich, media display formats meet Interactive Advertising Bureau (IAB) and Online Publishers Association (OPA) standards that run across AOL Media properties and other publisher sites. We’ve taken one important step towards spotlighting quality ad content with Project Devil on AOL Media properties, and now we’re taking a second by bringing Pictela into the AOL Advertising family."

"Pictela is an outstanding fit for AOL as we re-imagine the intersection of content, advertising and the consumer experience," said Jeff Levick, AOL’s President of Global Advertising and Strategy. "Pictela’s product development team is best-in-class, and its beautiful, content rich, media display formats meet Interactive Advertising Bureau (IAB) and Online Publishers Association (OPA) standards that run across AOL Media properties and other publisher sites. We’ve taken one important step towards spotlighting quality ad content with Project Devil on AOL Media properties, and now we’re taking a second by bringing Pictela into the AOL Advertising family."

"Having a great online reputation is key," she continues. "Now with Seller Ratings on mobile, businesses can extend this important information from desktop to mobile devices. By showcasing relevant and useful rating information for your business, the extension can help differentiate you from your competition and guide potential customers to purchase from your site. Seller Ratings are aggregated from merchant review sites all around the web and the extension will only show when a merchant’s online store has a rating of four or more stars and at least 30 reviews. As seen in the example below, the ad will display the merchant’s star rating as well as a clickable link to the seller’s reviews."

"Having a great online reputation is key," she continues. "Now with Seller Ratings on mobile, businesses can extend this important information from desktop to mobile devices. By showcasing relevant and useful rating information for your business, the extension can help differentiate you from your competition and guide potential customers to purchase from your site. Seller Ratings are aggregated from merchant review sites all around the web and the extension will only show when a merchant’s online store has a rating of four or more stars and at least 30 reviews. As seen in the example below, the ad will display the merchant’s star rating as well as a clickable link to the seller’s reviews."