According to a new study by IDC, the growth of cloud computing is on track to create nearly 14 million new jobs globally by 2015. IDC’s research, which was commissioned by Microsoft, predicts revenues from cloud innovation could reach $1.1 trillion per year by 2015, which, combined with cloud efficiencies, will drive significant organizational reinvestment and job growth.

“The cloud is going to have a huge impact on job creation,” says Susan Hauser, Microsoft corporate vice president of the Worldwide Enterprise and Partner Group. “It’s a transformative technology that will drive down costs, spur innovation, and open up new jobs and skillsets across the globe.”

One way in which the cloud is helping companies to be more innovative is by freeing up IT managers to work on more mission-critical projects.

“We deployed Microsoft Office 365 and Windows Intune for one of our clients, and the comment we heard from the chief operations officer is that he can actually schedule a meeting with the IT director to talk about strategic applications,” said Carol Reid, sales director for Agile IT, a Microsoft Tier 3 Cloud Champion Member headquartered in San Diego, Calif. “Whereas before, the IT director was chasing fires and tending to pretty basic plumbing, he now has the bandwidth to pursue truly strategic projects that move the business forward.”

Microsoft has also staked their claim in the cloud with Microsoft Web Apps, their suite of Office software that is accessed via cloud computing, and SkyDrive, the company’s cloud storage service. The services are accessible via computer or mobile device.

“For most organizations, cloud computing should be a no-brainer, given its ability to increase IT innovation and flexibility, lower capital costs, and help generate revenues that are multiples of spending,” said John F. Gantz, chief research officer and senior vice president at IDC. “A common misperception is cloud computing is a job eliminator, but in truth it will be a job creator — a major one. And job growth will occur across continents and throughout organizations of all sizes because emerging markets, small cities and small businesses have the same access to cloud benefits as large enterprises or developed nations.”

The report also indicates specific industries will generate job growth at different rates, and that public cloud investments will drive faster job growth than private cloud investments. Microsoft also estimates that cloud–related jobs will accrue evenly to businesses with 500 or fewer employees and those with more than 500 employees.

The booming economies of China and India are expected to account for nearly half of all new cloud-related jobs. China, in fact, is estimated to create nearly five million jobs thanks to investments in cloud computing. To illustrate more on how cloud computing will develop across the world, Microsoft put together a small infographic that details the global impact of cloud services on different countries’ economies.

Ultimately, the cloud will be an important force in helping to restore worldwide economic health, Hauser said. “The cloud is the No. 1 topic among CIOs from around the world,” she added. “They want to know how they can use it to fuel growth. And they want to be sure they have the right people and skills in place to make it happen.”

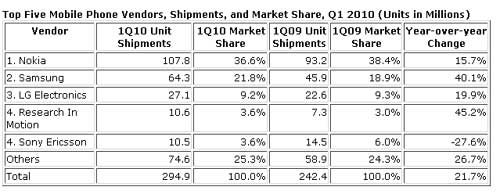

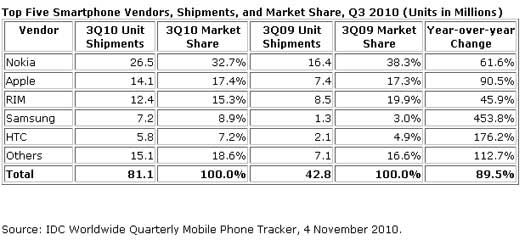

"That worldwide growth was driven primarily by vendors outside the top vendors is particularly noteworthy," said Ramon Llamas, senior research analyst with IDC’s Mobile Devices Technology and Trends team. "Directly contributing to this is growth in the smartphone category. Companies with a strict focus on the smartphone market, like RIM, Apple, and HTC have clearly benefited from steadily increasing user interest. But it’s not just smartphone vendors that have driven the market forward – it’s also the companies with a presence among entry-level handsets and mid-range devices, which have long been the domain of the worldwide leaders.

"That worldwide growth was driven primarily by vendors outside the top vendors is particularly noteworthy," said Ramon Llamas, senior research analyst with IDC’s Mobile Devices Technology and Trends team. "Directly contributing to this is growth in the smartphone category. Companies with a strict focus on the smartphone market, like RIM, Apple, and HTC have clearly benefited from steadily increasing user interest. But it’s not just smartphone vendors that have driven the market forward – it’s also the companies with a presence among entry-level handsets and mid-range devices, which have long been the domain of the worldwide leaders.