Whether it is a sports game, board game, or just in the game of life, nobody likes to feel like a loser. Over 160 million dollars were lost from American victims of identity theft in 2019. These victims can range from the most famous celebrity to a normal family of four. Identity theft affects every single person because it can happen to every single person and we should be aware of the signs.

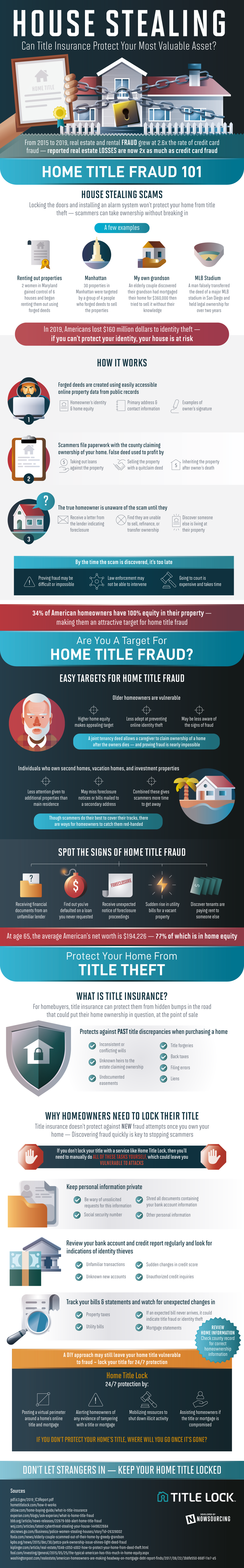

Identity theft has morphed into way more than just a creep who uses your credit card to buy himself a new video game. It has expanded into the realm of real estate and is the reason that real estate fraud losses are two times higher than credit card fraud losses. However, if you are vigilant you can spot the signs of home title fraud.

One of the first main indicators of home title fraud is the receival of financial documents from unknown senders. You can protect against this by knowing who you owe money to and not giving out your financial information to people whom you don’t know or trust. If you are unsure of whether or not a financial document is real, contact your financial provider and ask them about it. Your insurance provider can tell you how the homeowners insurance claim process works so that you aren’t scammed or tricked by an unscrupulous fraudster.

The next sign of fraud would be if you found out you defaulted on a loan that you were unaware of. It is always good to be involved in your accounts and holdings, especially loan payments. If you are aware of activity within your account it can help prevent any oversight that could lead to fraud. Make it a habit to check these things once a day if not more so that you understand what is happening with your money.

This may seem obvious but if you receive an unexpected note of foreclosure then this is an indicator that there is illicit activity concerning your home. Adhering to some of the previous precautions are a good way to protect against this because once home title fraud gets to this stage it is very difficult to refute and challenge it.

If you own multiple properties it is a good practice to check your bills especially the utility ones. A sudden unforeseen rise in these bills for vacant properties could be a sign of fraud. If you see this and have the facilities to go to the property it would be wise. If you can’t call the service provider and ask if there is any reason for the change.

Finally if you have tenants make sure that the money they pay you is going to you and not someone else. Well kept financial notes could be the key to keeping you fraud free.

By looking for these signs of fraud and taking the appropriate steps to mitigate them you can help make yourself less of a target to potential scammers. Having the knowledge and foresight to put precaution in place not only increases your protection but it can help you feel at ease with your status as a homeowner.

Source: HomeTitleLock.com