Demand Media shares are listing today in the New York Stock Exchange under the DMD symbol, as the company’s IPO of 8.9 million shares priced out at $17 a share (above estimates of $114 – $16).

The IPO raised a reported $151.3 million valuing the company at just under $1.5 billion.

According to the Dow Jones Newswires, "Revenue at Demand Media from its advertising and domain registrations grew throughout the economic downturn, though the company hasn’t been profitable in an operating or net basis since 2007, when it was bought by a venture and private equity investors including Oak Investment Partners, Spectrum Equity Investors, W Capital Partners and [CEO] Mr. Rosenblatt."

$1.5 is a pretty high valuation that is going to take a lot of ad clicks to live up to, and it’s going to take Google not hurting their search rankings too much.

The timing of this is quite interesting, as Google is now talking about a shifted focus to "content farms," which Demand Media is often labeled as. Google calls content farms sites with "shallow or low-quality content".

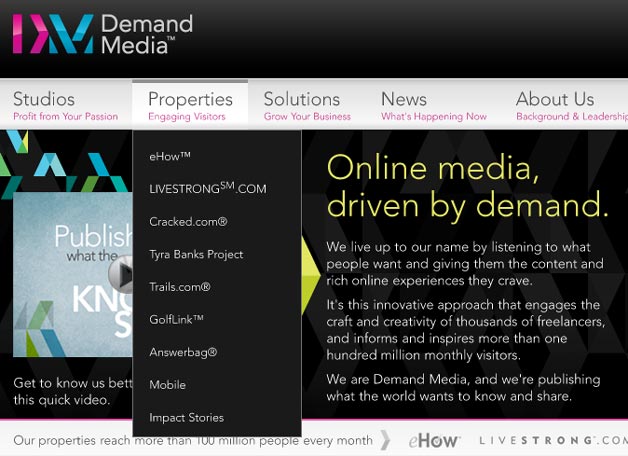

The quality of Demand’s content is mixed, and the company has expressed determination to improve it. The story gets more complicated, as iEntry CEO (and WebProNews Publisher) Rich Ord outlined in his open letter to Google here.

If Google intends to hold true to its recent statements, Demand is going to keep the quality up to get the benefit of Google’s traffic, which has been its main driver.