You’ve got to wonder how things would be looking if Groupon had agreed to be acquired by Google when it had the chance. Groupon has been taking the world by storm, and has been considered one of the hottest startups of the past year or so. Lots of other companies are catching on to Groupon’s game, however, and it’s looking less likely than any one company – Groupon included – will be able to “own” the deals space.

In a recent article, we looked at how new deals sites are popping up in all kinds of markets and verticals, and businesses are more than happy to spread their advertising dollars around among different ones. Google is said to have offered as much as $6 billion for Groupon, and a lot of people were shocked that they turned it down, let alone that Google would offer that much in the first place.

Should Groupon have sold to Google? Tell us what you think.

It must be quite the interesting time for Groupon. Not only is their President and COO Rob Solomon on the way out, but the company might be planning an IPO as well as expanding in Palo Alto. After reports that U.S. revenues were down 30% in February, more bad news comes today via Yipit, a popular site that aggregates and recommends daily deals.

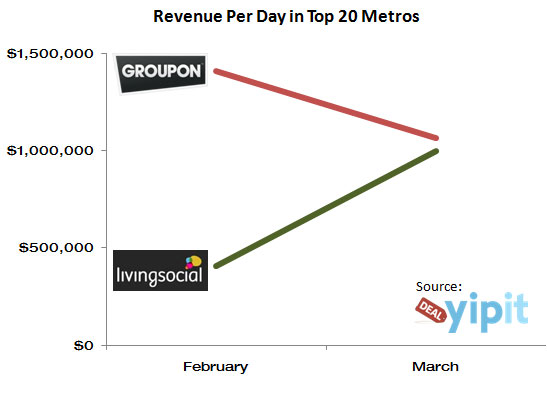

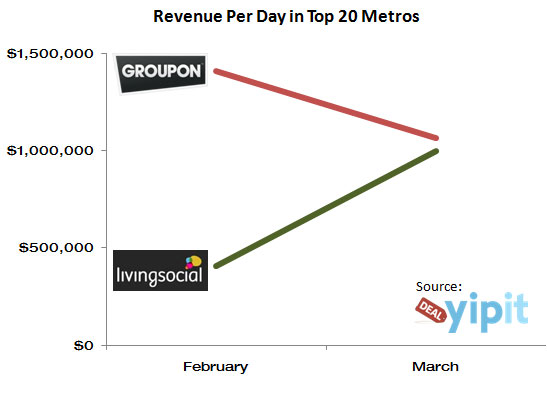

According to Yipit, they ran some numbers from their database and found that Groupon is having a worse March than it did February, down 32% this month. Yipit suggests that the decline could possibly be caused by people simply being tired of wading through big deals, but that wouldn’t explain why LivingSocial is up 59% this month. That’s right, according to Yipit, they have pulled virtually even with Groupon in terms of revenues in the top 20 markets. Here is the graph they show:

What could be causing this shift in where people get their daily deals? Yipit suggests that since 25 millions people now use LivingSocial, people are using multiple services with regularity. It could also be due to Groupon’s targeting of specific deals for specific zips codes in large metro areas. These deals might be tailored to an specific area but not be as desirable as the general daily deals that people are used to. It could also be a demographic issue:

Young, single-oriented Groupon has 68% of subscribers between the ages of 18 to 34, while 64% of LivingSocial’s is 34 and above. Groupon’s competitors may have a broader appeal as the Daily Deal universe expand beyond young singles.

Google will emerge in the Deals space. Make no mistake. In fact, Google’s Marissa Mayer recently spoke about how Google already has some Groupon-like products. Then there’s Facebook. Foursquare is also doing some very interesting things for local businesses (CEO Dennis Crowley has not ruled out a potential partnership with Google either). Bing, Yahoo, and others are looking at more of a deal aggregation approach, so consumers don’t have to rely on any one deals provider. Groupon will most likely continue to remain relevant, but they may find the playing field much more level. That goes for LivingSocial too, by the way. They’ve been doing a lot of TV advertising, and have done a good job of growing their brand, but if Groupon can’t “own” the deals space, it’s hard to see why LivingSocial “can”.

The fact of the matter is that there are plenty of businesses looking to give deals to customers, and there are plenty of services that will get them in front of people.

With expanding competition in the deals market, can Groupon remain the leader? Share your thoughts.