With Facebook’s IPO filing this week, lots of little tidbits of information about the company came to light. Josh Wolford has reported on the fact that, as of 2013, Facebook founder Mark Zuckerberg’s salary will be set at $1 per year.

Zuckerberg is certainly not the only exec to do this. In the wake of the Wall Street financial crisis, the salaries of CEOs have come under public scrutiny, particularly those whose customers lost lots of money. So, some companies have made hay out of the fact that their CEO takes a relatively modest salary.

But, a $1 CEO is a different breed. Why would Zuckerberg do it? No one lost any money due to Facebook’s market maneuvers or unregulated activities. Overall approval of Facebook in general is high. Public opinion of Zuckerberg is good, especially after the movie “The Social Network“. Zuckerberg is a capitalist hero, a geek wunderkind, the model of everything both the left and right love in America. Who would blame him for taking his company public, then raking in billions off something that not one user has to pay for?

What about other $1 execs? Others who have been listed as having single-digit salaries include Apple’s Steve Jobs, Chrysler’s Lee Iacocca, New York mayor Michael Bloomberg, former California governor Arnold Schwarzenegger, HP’s Meg Whitman, and the Google triumvirate of Sergey Brin, Larry Page and Eric Schmidt.

The public perception of these salaries is, and is intended to be, that these execs are sacrificing for the sake of the company or municipality they are overseeing. And, it is not to say that altruistic intentions are not involved, especially in the case of execs at the helm of a company they started.

In the case of elected officials like Schwarzenegger and Bloomberg, the low salary reflects a commitment to turn around a bad situation they were elected to fix. It endears them to voters and constituents. The rewards in terms of public goodwill are great.

The actions of these men hearken back to a time when America was clawing its way out of a bad spot. Around World War I, many business executives came to serve in branches of the U.S. government where they had business expertise. These execs took only a single dollar in salary and were called One-Dollar Men.

Lee Iacocca was brought in to turn around a failing Chrysler Corporation in 1978. Iacocca had been run out of Ford Motor Company after overseeing the public fiasco that was the Ford Pinto. His reputation was on the rocks due to his “safety doesn’t sell” statements about the fire-hazard pinto. But, Chrysler recognized that Iacocca was, under all the public hype, still an excellent top man.

Iacocca took a $1 annual salary from Chrysler, which drew attention to his efforts as a rescuer of the company, a core part of America’s auto industry. It also helped rehabilitate Iacocca’s public image.

The public image advantages to taking a low salary are easy to see, whether in a failing-company scenario or in the case of a government leader working to turn around a state.

But, are there actually financial advantages to an exec who takes a very low salary to run a successful company? There certainly could be.

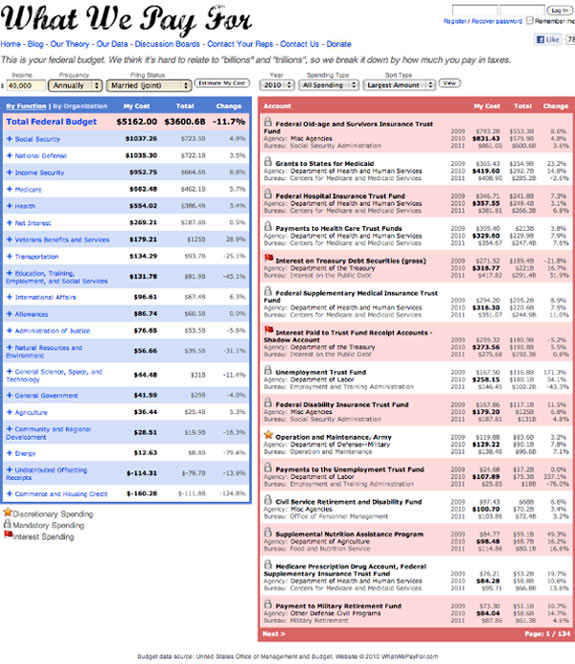

1) Lower Taxes. This one is simple. Payroll taxes are higher than taxes on capital gains in the United States. This fact has led to many political arguments in the past couple of years, and has become much more common knowledge as a result.

Mark Zuckerberg’s current outright salary is $600,000 per year. In terms of payroll tax, he is in a 35% tax bracket. If, however, he reduces his salary to $1 and takes stock options instead – a great deal for a company with an IPO like Facebook – he deals with capital gains tax, which is currently at 15%. Zuckerberg currently holds 28.2% of the company.

This makes sense, but let’s get a little crazy with the possibilities here.

2) No Taxes. Imagine this one, as proposed in a CNBC story. If Zuckerberg were to forego and future bonuses or additional stock rewards, and not cash out any stock (resulting in capital gains), he would effectively have an income of $1 a year, all while building a fortune as his stock rises, splits, etc. He has accrued enough money to live comfortably, though not extravagantly, for a while. To have no tax burden at all, continually plowing your resources back in on themselves, will build an even bigger legacy.

3) Living On Debt. Even once Zuckerberg’s savings runs out, he could live off a Home Equity Line of Credit. CNBC explains that scenario:

People sometimes talk about the rich “living off the interest” of their wealth. But that’s not really a tax efficient way to live if you are really, really wealthy. It’s better to live off of debt and muni bonds.

The best thing for Zuckerberg would be a home equity line of credit—perhaps multiple home equity lines. He would borrow against the value of real estate he owns. The money he receives from the HELOC is debt rather than income, which means it isn’t taxed. Even better, the interest he pays on the HELOC can be used to offset other income he may earn.

4) Taxpayer Money. This one is highly unlikely, but it is possible. If Mark Zuckerberg shows an income between $1 and $13,650 (2011 tables), he could qualify for Earned Income Tax Credit, even without children. Sounds silly, but there it is. with up to three children, he could collect up to $5,751 dollars in EIC per year, as well as Medicaid and Food Stamp benefits.

Now, this is not to say that Mark Zuckerberg intends to do any of these things, except maybe #1. But, once you have made your bones in business at the level of a Zuckerberg, the possibilities change. The planning can change. You don’t worry about things that many “normal” people worry about. You don’t care when W-2s arrive. You don’t concern yourself with bounced check fees. And, you don’t plan your tax strategy with “normal people” considerations like home mortgage interest, charitable contributions and job hunting expenses. These things are used, but they are not the core of your strategy.

Adding zeroes to the end of some of your numbers allows you to reduce the number most “normal people” worry about to a single dollar, and still build a kingdom.

And, you can give it away.

On December 9, 2010, Mark Zuckerberg, along with Bill Gates and Warren Buffett signed a “Giving Pledge” in which they promised to donate at least half their wealth over the course of time to charity. These men are all listed in the Top Twenty of Forbe’s World’s Most Powerful People (Gates is #5, Zuckerberg # 9, Buffett #20). They could do a lot in the world with the combination of wealth and influence they hold. Gates, for example, has long taken on the eradication of malaria from the Earth as his personal mission. And, in the past 10 years, incidence of malaria in the world has gone down 20%.

As big ticket financial advisers would say, “The more you keep, the more you can give away.”

Apple users can download the free

Apple users can download the free

"The new law and the regulations implementing it are an unconstitutional and blatant violation of Colorado consumers’ privacy," said Jerry Cerasale, Senior Vice President, Government Affairs,

"The new law and the regulations implementing it are an unconstitutional and blatant violation of Colorado consumers’ privacy," said Jerry Cerasale, Senior Vice President, Government Affairs,  Here’s the thing: Ireland offers a lower corporate tax rate than most other places in the world. So Google set up its EU headquarters in Ireland, and can save money by letting Ireland tax all sorts of revenue, regardless of its point of origin.

Here’s the thing: Ireland offers a lower corporate tax rate than most other places in the world. So Google set up its EU headquarters in Ireland, and can save money by letting Ireland tax all sorts of revenue, regardless of its point of origin. The state said it will waive all back sales taxes and penalties for online retailers that sign an agreement by August 31 to start collecting sales tax.

The state said it will waive all back sales taxes and penalties for online retailers that sign an agreement by August 31 to start collecting sales tax.