Yahoo released its earnings report for Q3. This includes revenue excluding traffic acquisition costs of $1,072 million for the quarter, down 5% year-over-year. Income from operations also decreased 6% to $177 million compared to $189 year-over-year.

The company says the decreases were mainly due to the Search Alliance with Microsoft.

“We’re pleased that revenue, operating income and EPS were all above consensus this quarter,” said Tim Morse, CFO and Interim CEO,Yahoo!. “My focus, and that of the whole company, is to move the business forward with new technology, partnerships, products, and premium personalized content — all with an eye toward growing monetization.”

The company is of course still looking for a permanent replacement for recently ousted CEO Carol Bartz.

Here’s the release in its entirety:

Yahoo! Reports Third Quarter 2011 Results

Revenue, Operating Income, and EPS Exceed Consensus

SUNNYVALE, Calif.–(BUSINESS WIRE)– Yahoo! Inc. (NASDAQ:YHOO) today reported results for the quarter ended September 30, 2011.

Revenue excluding traffic acquisition costs (“revenue ex-TAC”) was $1,072 million for the third quarter of 2011, a 5 percent decrease from the third quarter of 2010. Income from operations decreased 6 percent to $177 million in the third quarter of 2011, compared to $189 million in the third quarter of 2010. The year over year decreases were primarily due to the revenue share related to the Search Agreement with Microsoft.

GAAP revenue was $1,217 million for the third quarter of 2011, a 24 percent decrease from the third quarter of 2010, primarily due to the required change in revenue presentation related to the Search Agreement and the associated revenue share with Microsoft.

Net earnings per diluted share decreased 21 percent to $0.23 in the third quarter of 2011, compared to $0.29 in the third quarter of 2010. Adjusted for the two items noted below, diluted earnings per share increased 32 percent to $0.21 in the third quarter of 2011, compared to$0.16 in the third quarter of 2010. Net earnings per diluted share for the third quarter of 2011 included a benefit of $0.02 per diluted share related to the dilution of the Company’s ownership interest in Alibaba Group as a result of option exercises and the issuance of stock toAlibaba Group employees during its quarter ended June 30, 2011. Net earnings per diluted share for the third quarter of 2010 included a benefit of $0.13 per diluted share related to the gain on sale of HotJobs.

Financials at a Glance

| Quarterly Results (in millions, except percentages and per share amounts) |

|

|

Q3 2010 |

|

Q3 2011 |

|

Percent Change |

| Revenue ex-TAC |

|

$1,124 |

|

$1,072 |

|

(5)% |

| GAAP revenue |

|

$1,601 |

|

$1,217 |

|

(24)% |

| Income from operations |

|

$189 |

|

$177 |

|

(6)% |

| Net earnings |

|

$396 |

|

$293 |

|

(26)% |

| Net earnings per diluted share |

|

$0.29 |

|

$0.23 |

|

(21)% |

“We’re pleased that revenue, operating income and EPS were all above consensus this quarter,” said Tim Morse, CFO and Interim CEO,Yahoo!. “My focus, and that of the whole company, is to move the business forward with new technology, partnerships, products, and premium personalized content — all with an eye toward growing monetization.”

Business Highlights

- Yahoo! is home to 10 number one properties globally and ranks among the top three in 21 categories worldwide. Yahoo! has ten out of the top ten original video programs in the U.S. on the Web (Source: comScore Media Builder Custom Report, US, August 2011, among a set including more than 75 original video programs, as custom-defined by Yahoo!, on the following properties: Yahoo!, YouTube,Hulu, MSN, AOL, Forbes, PopSugar, IGN, TMZ, New York Times, Smosh.com, ABC News, Sugar, Funny or Die, She Knows, CraveOnline).

- Yahoo! continued to modernize its technology platforms, with 28 additional sites across the Americas, EMEA and Asia Pacific going live on the new global Yahoo! Publishing Platform, bringing the total to 95.

- Yahoo! and ABC News announced a strategic alliance that combines Yahoo! News’ unmatched audience, as well as its depth and breadth of content, with ABC News’ global news gathering operation and trusted anchors and reporters. The alliance kicked off with the launch of GoodMorningAmerica.com on Yahoo! and a live stream of anchor George Stephanopoulos interviewing President Barack Obama live at the White House.

- Yahoo! introduced a full slate of original, premium, TV-quality Web shows in tandem with the beta launch of its re-vamped video destination, Yahoo! Screen. The eight new shows add to Yahoo!’s existing industry-leading video programming and star top Hollywoodtalent including Judy Greer (The Descendants, Arrested Development), Niecy Nash (Reno 911, Dancing with the Stars), Cameron Mathison (All My Children, Dancing with the Stars), and Morgan Spurlock (Super-Size Me, 30 Days), among others.

- Yahoo! was the exclusive live broadcast partner for the William J. Clinton Foundation’s special concert titled “A Decade of Difference: A Concert Celebrating 10 Years of the William J. Clinton Foundation.” The concert included special performances by Stevie Wonder, Lady Gaga, The Edge and Bono, Usher, Juanes, Kenny Chesney and K’naan.

- Yahoo! launched a new way to discover and connect with the world’s most popular content on both Yahoo! and Facebook. Beginning with Yahoo! News in the U.S., people can discover and connect around the news and information they are enjoying on Yahoo! seamlessly through updates on Facebook. People will also be able to feature their TV watching activity on IntoNowTM from Yahoo! on their Facebook profile.

- As part of Hispanic Heritage Month, Yahoo! live-streamed the first-ever Hispanic-focused online roundtable with President Barack Obama, giving people the opportunity to submit questions to the President on the issues that are important to them.

- Yahoo! debuted MLB.com® Full Count, a new online video offering produced and powered by MLB.com in partnership with Yahoo! Sports that allows fans to follow live Major League Baseball action through the regular season. Yahoo! and Gow Broadcasting also launched Yahoo! Sports Radio. The new, national sports radio network can be heard on over 180 affiliate radio stations across the country, Sirius Satellite Radio®, and a number of digital and mobile partners.

Search Alliance Impact

Yahoo!’s results for the third quarter of 2011 reflect $53 million in search operating cost reimbursements from Microsoft under the Search Agreement, which amount is equal to the search operating costs incurred by Yahoo! in the third quarter. Search operating cost reimbursements are expected to continue to decline as Yahoo! fully transitions all markets to Microsoft’s search platform and the underlying expenses are no longer incurred under our cost structure. Our business outlook for total expenses reflects these anticipated savings.

Yahoo!’s results for the third quarter of 2011 also reflect $4 million in transition cost reimbursements from Microsoft under the Search Agreement. During the third quarter Yahoo!’s cumulative transition costs exceeded the $150 million reimbursement cap specified in the Search Agreement. Transition costs in excess of the cap will not be subject to reimbursement.

In order to create more financial certainty, Microsoft and Yahoo! recently agreed to extend the RPS Guarantee in the U.S. and Canadathrough March 2013. Microsoft and Yahoo! remain fully committed to the success of the Search Alliance, and the RPS Guarantee extension represents an important sign of that commitment.

Third Quarter 2011 Revenue Highlights

- Display revenue ex-TAC was $449 million, which was flat compared to $448 million for the third quarter of 2010.

- GAAP display revenue was $502 million, a decrease of 2 percent, compared to $514 million for the third quarter of 2010.

- Search revenue ex-TAC was $374 million, a 13 percent decrease compared to $428 million for the third quarter of 2010.

- GAAP search revenue was $467 million, a 44 percent decrease compared to $839 million for the third quarter of 2010.

Cash Flow and Cash Balance

- Cash flow from operating activities for the third quarter of 2011 was $356 million, a 3 percent increase compared to $346 million for the same period of 2010.

- Free cash flow was $247 million for the third quarter of 2011, a 1 percent decrease compared to $250 million for the same period of 2010.

- Cash, cash equivalents, and investments in marketable debt securities were $2,870 million at September 30, 2011 compared to$3,629 million at December 31, 2010, a decrease of $759 million. During the third quarter of 2011, Yahoo! repurchased 44 million shares for $593 million. During the nine months ended September 30, 2011, Yahoo! repurchased 82 million shares for $1,203 million.

Business Outlook

Revenue ex-TAC for the fourth quarter of 2011 is expected to be in the range of $1,125 million to $1,235 million. Based on the terms of the Search Agreement with Microsoft, Microsoft retains a revenue share of 12 percent of the net (after TAC) search revenue generated on Yahoo! Properties and Affiliate sites in transitioned markets. Yahoo! reports the net revenue it receives under the Search Agreement as revenue and no longer presents the associated TAC within cost of revenue. Accordingly, for transitioned markets Yahoo! reports GAAP revenue associated with the Search Agreement on a net (after TAC) basis rather than a gross basis. For markets that have not yet transitioned, revenue continues to be recorded on a gross basis, and TAC is recorded in cost of revenue. GAAP revenue for the fourth quarter of 2011 is expected to be in the range of $1,275 million to $1,395 million. Total expenses (cost of revenue plus total operating expenses) for the fourth quarter of 2011 is expected to be in the range of $1,075 million to $1,135 million. Total expenses less TAC for the fourth quarter of 2011 is expected to be in the range of $925 million to $975 million. Income from operations for the fourth quarter of 2011 is expected to be in the range of $200 million to $260 million.

Business outlook for revenue ex-TAC is being provided to reflect the underlying dynamics of the business during the Microsoft transition and to facilitate comparisons to prior periods.

Conference Call

Yahoo! will host a conference call to discuss third quarter 2011 results at 5 p.m. Eastern Time today. A live Webcast of the conference call, together with supplemental financial information, can be accessed through the Company’s Investor Relations Website athttp://investor.yahoo.com/results.cfm. In addition, an archive of the Webcast can be accessed through the same link. An audio replay of the call will be available for one week following the conference call by calling (888) 286-8010 or (617) 801-6888, reservation number: 36003638.

Note Regarding Non-GAAP Financial Measures

This press release and its attachments include the following financial measures defined as non-GAAP financial measures by the Securities and Exchange Commission (“SEC”): revenue ex-TAC; free cash flow; total expenses less TAC; non-GAAP net income; and non-GAAP net income per diluted share. These measures may be different than non-GAAP financial measures used by other companies. The presentation of this financial information is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with generally accepted accounting principles (“GAAP”). Explanations of the Company’s non-GAAP financial measures and reconciliations of these financial measures to the GAAP financial measures the Company considers most comparable are included in the accompanying “Note to Unaudited Condensed Consolidated Statements of Income,” “Supplemental Financial Data,” “GAAP Net Income to Non-GAAP Net Income Reconciliation,” and “Business Outlook.”

About Yahoo!

Yahoo! is the premier digital media company, creating deeply personal digital experiences that keep more than half a billion people connected to what matters most to them, across devices and around the globe. And Yahoo!’s unique combination of Science + Art + Scale connects advertisers to the consumers who build their businesses. Yahoo! is headquartered in Sunnyvale, California. For more information, visit the pressroom (pressroom.yahoo.net) or the company’s blog, Yodel Anecdotal (yodel.yahoo.com).

“Affiliates” refers to the third-party entities that have integrated Yahoo!’s advertising offerings into their Websites or other offerings (those Websites and other offerings, “Affiliate sites”).

“RPS Guarantee in the U.S. and Canada” refers to Microsoft’s obligation under the Search Agreement to guarantee Yahoo!’s revenue per search in the U.S. and Canada on Yahoo! Properties following the transition of paid search services to Microsoft’s platform in those markets, which was completed in the fourth quarter of 2010.

“Search Agreement” refers to the Search and Advertising Services and Sales Agreement between Yahoo! and Microsoft Corporation.

“TAC” refers to traffic acquisition costs. TAC consists of payments to Affiliates and payments made to companies that direct consumer and business traffic to Yahoo! Properties.

“Yahoo! Properties” refers to the online properties and services that Yahoo! provides to users.

This press release and its attachments contain forward-looking statements concerning Yahoo!’s expected financial performance (including, without limitation, statements and information in the Business Outlook and Search Alliance Impact sections and the quotation from management), as well as Yahoo!’s strategic and operational plans. Risks and uncertainties may cause actual results to differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the impact of management and organizational changes; the implementation and results of Yahoo!’s ongoing strategic and cost initiatives; Yahoo!’s ability to compete with new or existing competitors; reduction in spending by, or loss of, advertising customers; the demand by customers for Yahoo!’s premium services; interruptions or delays in the provision of Yahoo!’s services; security breaches; acceptance by users of new products and services; risks related to joint ventures and the integration of acquisitions; risks related to Yahoo!’s international operations; failure to manage growth and diversification; adverse results in litigation, including intellectual property infringement claims and recent derivative and class actions related to Alipay; Yahoo!’s ability to protect its intellectual property and the value of its brands; dependence on key personnel; dependence on third parties for technology, services, content, and distribution; general economic conditions and changes in economic conditions; transition and implementation risks associated with the Search Agreement with Microsoft Corporation; and risks related to the Framework Agreement with Softbank Corporation, Alibaba Group and other parties regarding Alipay, including the failure to consummate or delays in consummating the transactions contemplated by the agreement. All information set forth in this press release and its attachments is as of October 18, 2011. Yahoo! does not intend, and undertakes no duty, to update this information to reflect subsequent events or circumstances; however, Yahoo! may update its business outlook or any portion thereof at any time in its discretion. More information about potential factors that could affect the Company’s business and financial results is included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, and Quarterly Report on Form 10-Q for the quarter ended June 30, 2011, which are on file with the SEC and available on the SEC’s website at www.sec.gov. Additional information will also be set forth in those sections in Yahoo!’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2011, which will be filed with the SEC in the fourth quarter of 2011.

Yahoo!, IntoNow, and the Yahoo! logos are trademarks and/or registered trademarks of Yahoo! Inc. All other names are trademarks and/or registered trademarks of their respective owners.

Yahoo! Inc.

Unaudited Condensed Consolidated Statements of Income

(in thousands, except per share amounts) |

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2010 |

|

|

|

2011 |

|

|

|

2010 |

|

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

1,601,203 |

|

|

$ |

1,216,665 |

|

|

$ |

4,799,542 |

|

|

$ |

3,660,046 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

680,754 |

|

|

|

359,276 |

|

|

|

2,069,858 |

|

|

|

1,107,893 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

920,449 |

|

|

|

857,389 |

|

|

|

2,729,684 |

|

|

|

2,552,153 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

320,977 |

|

|

|

290,486 |

|

|

|

965,983 |

|

|

|

833,032 |

|

|

Product development |

|

|

269,725 |

|

|

|

254,958 |

|

|

|

804,354 |

|

|

|

744,538 |

|

|

General and administrative |

|

|

126,816 |

|

|

|

128,977 |

|

|

|

362,577 |

|

|

|

383,531 |

|

|

Amortization of intangibles |

|

|

8,018 |

|

|

|

8,435 |

|

|

|

24,000 |

|

|

|

25,067 |

|

|

Restructuring charges, net |

|

|

5,758 |

|

|

|

(2,721 |

) |

|

|

20,222 |

|

|

|

8,091 |

|

|

Total operating expenses |

|

|

731,294 |

|

|

|

680,135 |

|

|

|

2,177,136 |

|

|

|

1,994,259 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

189,155 |

|

|

|

177,254 |

|

|

|

552,548 |

|

|

|

557,894 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

191,351 |

|

|

|

18,046 |

|

|

|

290,267 |

|

|

|

17,407 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes and earnings in equity interests |

|

|

380,506 |

|

|

|

195,300 |

|

|

|

842,815 |

|

|

|

575,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes |

|

|

(86,413 |

) |

|

|

(55,731 |

) |

|

|

(204,381 |

) |

|

|

(163,480 |

) |

| Earnings in equity interests |

|

|

104,166 |

|

|

|

158,775 |

|

|

|

288,247 |

|

|

|

349,857 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

398,259 |

|

|

|

298,344 |

|

|

|

926,681 |

|

|

|

761,678 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net income attributable to noncontrolling interests |

|

|

(2,128 |

) |

|

|

(5,053 |

) |

|

|

(7,038 |

) |

|

|

(8,423 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Yahoo! Inc. |

|

$ |

396,131 |

|

|

$ |

293,291 |

|

|

$ |

919,643 |

|

|

$ |

753,255 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Yahoo! Inc. common stockholders per share – diluted(1) |

|

$ |

0.29 |

|

|

$ |

0.23 |

|

|

$ |

0.66 |

|

|

$ |

0.58 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in per share calculation – diluted |

|

|

1,343,094 |

|

|

|

1,259,576 |

|

|

|

1,382,255 |

|

|

|

1,296,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense by function: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

$ |

698 |

|

|

$ |

956 |

|

|

$ |

2,289 |

|

|

$ |

2,479 |

|

|

Sales and marketing |

|

|

19,066 |

|

|

|

16,759 |

|

|

|

54,284 |

|

|

|

42,829 |

|

|

Product development |

|

|

22,647 |

|

|

|

21,093 |

|

|

|

81,152 |

|

|

|

64,296 |

|

|

General and administrative |

|

|

8,686 |

|

|

|

12,139 |

|

|

|

31,752 |

|

|

|

35,507 |

|

|

Restructuring expense reversals, net |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(1,278 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

The impact of outstanding stock awards of entities in which the Company holds equity interests that are accounted for using the equity method reduced the Company’s diluted earnings per share by $0.01 for the nine months ended September 30, 2010. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue ex-TAC |

|

$ |

1,124,419 |

|

|

$ |

1,071,674 |

|

|

$ |

3,382,978 |

|

|

$ |

3,212,128 |

|

| Free cash flow |

|

$ |

250,241 |

|

|

$ |

246,714 |

|

|

$ |

441,090 |

|

|

$ |

398,790 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yahoo! Inc.

Note to Unaudited Condensed Consolidated Statements of Income

This press release and its attachments include the non-GAAP financial measures of revenue excluding traffic acquisition costs (“revenue ex-TAC”), free cash flow, total expenses (GAAP cost of revenue plus GAAP total operating expenses) less TAC, non-GAAP net income, and non-GAAP net income per diluted share, which are reconciled to revenue, cash flow from operating activities, total expenses (GAAP cost of revenue plus GAAP total operating expenses), net income attributable to Yahoo! Inc., and net income attributable to Yahoo! Inc. common stockholders per share – diluted, which we believe are the most comparable GAAP measures. We use these non-GAAP financial measures for internal managerial purposes and to facilitate period-to-period comparisons. We describe limitations specific to each non-GAAP financial measure below. Management generally compensates for limitations in the use of non-GAAP financial measures by relying on comparable GAAP financial measures and providing investors with a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure or measures. Further, management uses non-GAAP financial measures only in addition to and in conjunction with results presented in accordance with GAAP. We believe that these non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP results, provide a more complete understanding of factors and trends affecting our business and operating costs. These non-GAAP measures should be considered as a supplement to, and not as a substitute for, or superior to, revenue, cash flow from operating activities, total expenses, net income attributable to Yahoo! Inc., and net income attributable toYahoo! Inc. common stockholders per share – diluted calculated in accordance with GAAP.

Revenue ex-TAC is a non-GAAP financial measure defined as GAAP revenue less TAC. TAC consists of payments made to third-party entities that have integrated our advertising offerings into their Websites or other offerings (those Websites and other offerings, “Affiliate sites”) and payments made to companies that direct consumer and business traffic to Yahoo!’s online properties and services (“Yahoo! Properties”). Based on the terms of the Search Agreement with Microsoft, Microsoft retains a revenue share of 12 percent of the net (after TAC) search revenue generated on Yahoo! Properties and Affiliate sites in transitioned markets. Yahoo! reports the net revenue it receives under the Search Agreement as revenue and no longer presents the associated TAC within cost of revenue. Accordingly, for transitioned markets Yahoo! reports GAAP revenue associated with the Search Agreement on a net (after TAC) basis rather than a gross basis. For markets that have not yet transitioned, revenue continues to be recorded on a gross basis, and TAC is recorded in cost of revenue. We present revenue ex-TAC to provide investors a metric used by the Company for evaluation and decision-making purposes during the Microsoft transition and to provide investors with comparable revenue numbers when comparing periods preceding, during and following the transition period. We present revenue ex-TAC business outlook to reflect the underlying dynamics of the business during the Microsoft transition and to facilitate comparisons to prior periods. A limitation of revenue ex-TAC is that it is a measure which we have defined for internal and investor purposes that may be unique to the Company, and therefore it may not enhance the comparability of our results to other companies in our industry who have similar business arrangements but address the impact of TAC differently. Management compensates for these limitations by also relying on the comparable GAAP financial measures of revenue and cost of revenue, which includes TAC in non-transitioned markets.

Free cash flow is a non-GAAP financial measure defined as cash flow from operating activities (adjusted to include excess tax benefits from stock-based awards), less acquisition of property and equipment, net and dividends received from equity investees. We consider free cash flow to be a liquidity measure which provides useful information to management and investors about the amount of cash generated by the business after the acquisition of property and equipment, which can then be used for strategic opportunities including, among others, investing in the Company’s business, making strategic acquisitions, strengthening the balance sheet, and repurchasing stock. A limitation of free cash flow is that it does not represent the total increase or decrease in the cash balance for the period. Management compensates for this limitation by also relying on the net change in cash and cash equivalents as presented in the Company’s unaudited condensed consolidated statements of cash flows prepared in accordance with GAAP which incorporates all cash movements during the period.

Total expenses less TAC is a non-GAAP financial measure defined as total expenses (GAAP cost of revenue plus GAAP total operating expenses) less TAC. We consider total expenses less TAC to be a useful indicator of our operating costs. We exclude TAC from this measure because TAC generally varies based on the revenue we earn from traffic supplied by certain third parties, and doing so assists investors in understanding the operating cost structure of our business. A limitation associated with the non-GAAP measure of total expenses less TAC is that it does not reflect TAC. Management compensates for this limitation by also relying on the comparable GAAP financial measures of cost of revenue and income from operations, each of which includes TAC.

Non-GAAP net income is defined as net income attributable to Yahoo! Inc. excluding certain gains, losses, expenses, and their related tax effects that we do not believe are indicative of our ongoing results. We consider non-GAAP net income and non-GAAP net income per diluted share to be profitability measures which facilitate the forecasting of our results for future periods and allow for the comparison of our results to historical periods. A limitation of non-GAAP net income and non-GAAP net income per diluted share is that they do not include all items that impact our net income and net income per diluted share for the period. Management compensates for this limitation by also relying on the comparable GAAP financial measures of net income attributable to Yahoo! Inc. and net income attributable to Yahoo! Inc. common stockholders per share – diluted, both of which include the gains, losses, expenses and related tax effects that are excluded from non-GAAP net income and non-GAAP net income per diluted share.

Yahoo! Inc.

Supplemental Financial Data

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

|

|

2010 |

|

2011 |

|

2010 |

|

2011 |

| Revenue for groups of similar services: |

|

|

|

|

|

|

|

|

|

|

Display |

|

$ |

514,415 |

|

$ |

502,102 |

|

$ |

1,519,575 |

|

$ |

1,548,262 |

|

|

Search |

|

|

838,697 |

|

|

466,785 |

|

|

2,521,951 |

|

|

1,388,580 |

|

|

Other |

|

|

248,091 |

|

|

247,778 |

|

|

758,016 |

|

|

723,204 |

|

|

Total revenue |

|

$ |

1,601,203 |

|

$ |

1,216,665 |

|

$ |

4,799,542 |

|

$ |

3,660,046 |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue excluding traffic acquisition costs (“revenue ex-TAC”) for groups of similar services: |

|

|

|

GAAP display revenue |

|

$ |

514,415 |

|

$ |

502,102 |

|

$ |

1,519,575 |

|

$ |

1,548,262 |

|

|

TAC associated with display revenue |

|

|

(66,424 |

) |

|

(52,657 |

) |

|

(199,915 |

) |

|

(161,396 |

) |

|

Display revenue ex-TAC |

|

$ |

447,991 |

|

$ |

449,445 |

|

$ |

1,319,660 |

|

$ |

1,386,866 |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP search revenue |

|

$ |

838,697 |

|

$ |

466,785 |

|

$ |

2,521,951 |

|

$ |

1,388,580 |

|

|

TAC associated with search revenue for non-transitioned markets |

|

|

(410,328 |

) |

|

(92,334 |

) |

|

(1,215,109 |

) |

|

(286,382 |

) |

|

Search revenue ex-TAC |

|

$ |

428,369 |

|

$ |

374,451 |

|

$ |

1,306,842 |

|

$ |

1,102,198 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other GAAP revenue |

|

$ |

248,091 |

|

$ |

247,778 |

|

$ |

758,016 |

|

$ |

723,204 |

|

|

TAC associated with other GAAP revenue |

|

|

(32 |

) |

|

– |

|

|

(1,540 |

) |

|

(140 |

) |

|

Other revenue ex-TAC |

|

$ |

248,059 |

|

$ |

247,778 |

|

$ |

756,476 |

|

$ |

723,064 |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue ex-TAC: |

|

|

|

|

|

|

|

|

|

|

GAAP revenue |

|

$ |

1,601,203 |

|

$ |

1,216,665 |

|

$ |

4,799,542 |

|

$ |

3,660,046 |

|

|

TAC |

|

|

(476,784 |

) |

|

(144,991 |

) |

|

(1,416,564 |

) |

|

(447,918 |

) |

|

Revenue ex-TAC |

|

$ |

1,124,419 |

|

$ |

1,071,674 |

|

$ |

3,382,978 |

|

$ |

3,212,128 |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue ex-TAC by segment: |

|

|

|

|

|

|

|

|

|

|

Americas: |

|

|

|

|

|

|

|

|

|

|

GAAP revenue |

|

$ |

1,146,511 |

|

$ |

791,240 |

|

$ |

3,434,739 |

|

$ |

2,418,209 |

|

|

TAC |

|

|

(291,676 |

) |

|

(37,493 |

) |

|

(855,494 |

) |

|

(115,038 |

) |

|

Revenue ex-TAC |

|

$ |

854,835 |

|

$ |

753,747 |

|

$ |

2,579,245 |

|

$ |

2,303,171 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EMEA: |

|

|

|

|

|

|

|

|

|

|

GAAP revenue |

|

$ |

133,094 |

|

$ |

148,494 |

|

$ |

415,432 |

|

$ |

465,145 |

|

|

TAC |

|

|

(48,717 |

) |

|

(52,197 |

) |

|

(152,191 |

) |

|

(167,357 |

) |

|

Revenue ex-TAC |

|

$ |

84,377 |

|

$ |

96,297 |

|

$ |

263,241 |

|

$ |

297,788 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Asia Pacific: |

|

|

|

|

|

|

|

|

|

|

GAAP revenue |

|

$ |

321,598 |

|

$ |

276,931 |

|

$ |

949,371 |

|

$ |

776,692 |

|

|

TAC |

|

|

(136,391 |

) |

|

(55,301 |

) |

|

(408,879 |

) |

|

(165,523 |

) |

|

Revenue ex-TAC |

|

$ |

185,207 |

|

$ |

221,630 |

|

$ |

540,492 |

|

$ |

611,169 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue ex-TAC |

|

$ |

1,124,419 |

|

$ |

1,071,674 |

|

$ |

3,382,978 |

|

$ |

3,212,128 |

|

|

|

|

|

|

|

|

|

|

|

|

| Direct costs by segment (2): |

|

|

|

|

|

|

|

|

|

|

Americas |

|

$ |

135,899 |

|

$ |

134,672 |

|

$ |

426,136 |

|

$ |

403,612 |

|

|

EMEA |

|

|

27,730 |

|

|

35,488 |

|

|

88,878 |

|

|

100,165 |

|

|

Asia Pacific |

|

|

36,686 |

|

|

53,278 |

|

|

106,794 |

|

|

146,369 |

|

| Global operating costs (3) |

|

|

516,101 |

|

|

470,533 |

|

|

1,533,714 |

|

|

1,376,852 |

|

| Restructuring charges, net |

|

|

5,758 |

|

|

(2,721 |

) |

|

20,222 |

|

|

8,091 |

|

| Depreciation and amortization |

|

|

161,993 |

|

|

152,223 |

|

|

485,209 |

|

|

474,034 |

|

| Stock-based compensation expense |

|

|

51,097 |

|

|

50,947 |

|

|

169,477 |

|

|

145,111 |

|

|

Income from operations |

|

$ |

189,155 |

|

$ |

177,254 |

|

$ |

552,548 |

|

$ |

557,894 |

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of cash flow from operating activities to free cash flow: |

|

|

|

|

|

|

|

|

Cash flow from operating activities |

|

$ |

346,481 |

|

$ |

356,166 |

|

$ |

837,045 |

|

$ |

892,472 |

|

|

Acquisition of property and equipment, net |

|

|

(163,874 |

) |

|

(123,942 |

) |

|

(466,685 |

) |

|

(463,006 |

) |

|

Dividends received from equity investees |

|

|

– |

|

|

– |

|

|

(60,918 |

) |

|

(75,391 |

) |

|

Excess tax benefits from stock-based awards |

|

|

67,634 |

|

|

14,490 |

|

|

131,648 |

|

|

44,715 |

|

|

Free cash flow |

|

$ |

250,241 |

|

$ |

246,714 |

|

$ |

441,090 |

|

$ |

398,790 |

|

|

|

|

|

|

|

|

|

|

|

|

| (2) |

Direct costs for each segment include cost of revenue (excluding TAC) and other operating expenses that are directly attributable to the segment such as employee compensation expense (excluding stock-based compensation expense), local sales and marketing expenses, and facilities expenses. Prior to the fourth quarter of 2010, we included TAC in segment direct costs. For comparison purposes, prior period amounts have been revised to conform to the current presentation. |

| (3) |

Global operating costs include product development, service engineering and operations, marketing, customer advocacy, general and administrative, and other corporate expenses that are managed on a global basis and that are not directly attributable to any particular segment. |

|

|

Yahoo! Inc.

GAAP Net Income to Non-GAAP Net Income Reconciliation

(in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

|

|

|

|

|

|

|

|

2010 |

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net income attributable to Yahoo! Inc. |

|

|

|

|

$ |

396,131 |

|

|

$ |

293,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Restructuring charges, net |

|

|

|

|

|

5,758 |

|

|

|

(2,721 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (b) |

Gain on sale of HotJobs |

|

|

|

|

|

(186,345 |

) |

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (c) |

Non-cash gain related to the dilution of the Company’s ownership interest in Alibaba Group, which is included in earnings in equity interests |

|

|

|

|

|

– |

|

|

|

(25,083 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (d) |

To adjust the provision for income taxes to exclude the tax impact of items (a) through (b) above for the three months ended September 30, 2010 and September 30, 2011 |

|

|

|

|

|

5,223 |

|

|

|

365 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Net income |

|

|

|

|

$ |

220,767 |

|

|

$ |

265,852 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net income attributable to Yahoo! Inc. common stockholders per share – diluted |

|

|

|

|

$ |

0.29 |

|

|

$ |

0.23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Net income per share – diluted |

|

|

|

|

$ |

0.16 |

|

|

$ |

0.21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in non-GAAP per share calculation – diluted |

|

|

|

|

|

1,343,094 |

|

|

|

1,259,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, |

|

|

|

|

|

|

|

|

|

|

2010 |

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net income attributable to Yahoo! Inc. |

|

|

|

|

$ |

919,643 |

|

|

$ |

753,255 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Reimbursements from Microsoft for transition costs incurred in prior periods(4) |

|

|

|

|

|

(43,300 |

) |

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (b) |

Gain on sale of Zimbra, Inc. |

|

|

|

|

|

(66,130 |

) |

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (c) |

Restructuring charges, net |

|

|

|

|

|

20,222 |

|

|

|

8,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (d) |

Gain on sale of HotJobs |

|

|

|

|

|

(186,345 |

) |

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (e) |

Non-cash gain related to the dilution of the Company’s ownership interest in Alibaba Group, which is included in earnings in equity interests |

|

|

|

|

|

– |

|

|

|

(25,083 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (f) |

Yahoo!’s share of the non-cash loss related to impairments of assets held by Yahoo Japan, which is included in earnings in equity interests |

|

|

|

|

|

– |

|

|

|

32,652 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (g) |

To adjust the provision for income taxes to exclude the tax impact of items (a) through (d) above for the nine months ended September 30, 2010 and September 30, 2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,638 |

|

|

|

(3,224 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Net income |

|

|

|

|

$ |

660,728 |

|

|

$ |

765,691 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net income attributable to Yahoo! Inc. common stockholders per share – diluted (1) |

|

|

|

|

$ |

0.66 |

|

|

$ |

0.58 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Net income per share – diluted |

|

|

|

|

$ |

0.48 |

|

|

$ |

0.59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in non-GAAP per share calculation – diluted |

|

|

|

|

|

1,382,255 |

|

|

|

1,296,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

The impact of outstanding stock awards of entities in which the Company holds equity interests that are accounted for using the equity method reduced the Company’s diluted earnings per share by $0.01 for the nine months ended September 30, 2010. |

|

|

|

| (4) |

Non-GAAP net income excludes reimbursements for costs incurred in prior periods. The net $43 million reimbursement adjustment in the nine months ended September 30, 2010 is equal to the transition costs of $11 million and $32 millionincurred in the three months ended September 30, 2009 and December 31, 2009, respectively, in connection with the Search Agreement. |

|

|

|

|

|

|

|

|

Yahoo! Inc.

Business Outlook |

|

| The following business outlook is based on information and expectations as of October 18, 2011. Yahoo!’s business outlook as of today is expected to be available on the Company’s Investor Relations website throughout the current quarter. Yahoo! does not intend, and undertakes no duty, to update the business outlook to reflect subsequent events or circumstances; however, Yahoo! may update the business outlook or any portion thereof at any time at its discretion. |

|

|

|

Three Months

Ending

December 31, 2011

(in millions) |

|

|

|

|

| Revenue excluding traffic acquisition costs (“Revenue ex-TAC”): |

|

$ |

1,125 – 1,235 |

|

|

|

|

| Total expenses less TAC: |

|

$ |

925 – 975 |

|

|

|

|

| Income from operations: |

|

$ |

200 – 260 |

|

|

|

|

|

|

|

|

| Reconciliations: |

|

|

|

|

|

|

|

| Revenue excluding TAC: |

|

|

|

| GAAP Revenue |

|

$ |

1,275 – 1,395 |

| Less: TAC |

|

|

150 – 160 |

| Revenue ex-TAC |

|

$ |

1,125 – 1,235 |

|

|

|

|

| Total expenses less TAC: |

|

|

|

| Total expenses (GAAP Cost of revenue + GAAP Total operating expenses) |

|

$ |

1,075 – 1,135 |

| Less: TAC |

|

|

150 – 160 |

| Total expenses less TAC |

|

$ |

925 – 975 |

|

|

|

|

Yahoo! Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2010 |

|

|

2011 |

|

|

2010 |

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

398,259 |

|

|

$ |

298,344 |

|

|

$ |

926,681 |

|

|

$ |

761,678 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation |

|

|

132,048 |

|

|

|

128,922 |

|

|

|

387,240 |

|

|

|

404,823 |

|

| Amortization of intangible assets |

|

|

29,945 |

|

|

|

28,791 |

|

|

|

97,969 |

|

|

|

87,784 |

|

| Stock-based compensation expense, net |

|

|

51,097 |

|

|

|

50,947 |

|

|

|

169,477 |

|

|

|

143,833 |

|

| Non-cash restructuring charges |

|

|

2,741 |

|

|

|

– |

|

|

|

2,813 |

|

|

|

– |

|

| Tax benefits from stock-based awards |

|

|

69,346 |

|

|

|

(2,509 |

) |

|

|

91,268 |

|

|

|

9,974 |

|

| Excess tax benefits from stock-based awards |

|

|

(67,634 |

) |

|

|

(14,490 |

) |

|

|

(131,648 |

) |

|

|

(44,715 |

) |

| Deferred income taxes |

|

|

(13,151 |

) |

|

|

22,909 |

|

|

|

15,752 |

|

|

|

68,740 |

|

| Earnings in equity interests |

|

|

(104,166 |

) |

|

|

(158,775 |

) |

|

|

(288,247 |

) |

|

|

(349,857 |

) |

| Dividends received from equity investees |

|

|

– |

|

|

|

– |

|

|

|

60,918 |

|

|

|

75,391 |

|

| Gain from sale of investments, assets, and other, net |

|

|

(170,319 |

) |

|

|

(9,970 |

) |

|

|

(222,900 |

) |

|

|

12,822 |

|

| Changes in assets and liabilities, net of effects of acquisitions: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts receivable, net |

|

|

(859 |

) |

|

|

69,400 |

|

|

|

59,464 |

|

|

|

156,092 |

|

| Prepaid expenses and other |

|

|

48,765 |

|

|

|

(42,886 |

) |

|

|

(18,502 |

) |

|

|

10,407 |

|

| Accounts payable |

|

|

(21,229 |

) |

|

|

(16,495 |

) |

|

|

(19,789 |

) |

|

|

(27,316 |

) |

| Accrued expenses and other liabilities |

|

|

38,882 |

|

|

|

34,963 |

|

|

|

(169,707 |

) |

|

|

(351,081 |

) |

| Deferred revenue |

|

|

(47,244 |

) |

|

|

(32,985 |

) |

|

|

(123,744 |

) |

|

|

(66,103 |

) |

| Net cash provided by operating activities |

|

|

346,481 |

|

|

|

356,166 |

|

|

|

837,045 |

|

|

|

892,472 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition of property and equipment, net |

|

|

(163,874 |

) |

|

|

(123,942 |

) |

|

|

(466,685 |

) |

|

|

(463,006 |

) |

| Purchases of marketable debt securities |

|

|

(421,373 |

) |

|

|

(488,702 |

) |

|

|

(1,789,061 |

) |

|

|

(1,613,298 |

) |

| Proceeds from sales of marketable debt securities |

|

|

864,488 |

|

|

|

185,000 |

|

|

|

1,371,852 |

|

|

|

1,067,229 |

|

| Proceeds from maturities of marketable debt securities |

|

|

323,884 |

|

|

|

568,976 |

|

|

|

1,784,056 |

|

|

|

1,226,892 |

|

| Purchases of intangible assets |

|

|

(6,176 |

) |

|

|

(60 |

) |

|

|

(18,793 |

) |

|

|

(11,020 |

) |

| Proceeds from the sale of a divested business |

|

|

225,000 |

|

|

|

– |

|

|

|

325,000 |

|

|

|

– |

|

| Proceeds from the sale of investments |

|

|

– |

|

|

|

21,271 |

|

|

|

– |

|

|

|

21,271 |

|

| Acquisitions, net of cash acquired |

|

|

– |

|

|

|

– |

|

|

|

(112,361 |

) |

|

|

(68,812 |

) |

| Other investing activities, net |

|

|

(546 |

) |

|

|

(5,912 |

) |

|

|

(19,392 |

) |

|

|

(5,763 |

) |

| Net cash provided by investing activities |

|

|

821,403 |

|

|

|

156,631 |

|

|

|

1,074,616 |

|

|

|

153,493 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from issuance of common stock, net |

|

|

16,063 |

|

|

|

8,150 |

|

|

|

99,667 |

|

|

|

106,697 |

|

| Repurchases of common stock |

|

|

(867,994 |

) |

|

|

(593,485 |

) |

|

|

(1,749,311 |

) |

|

|

(1,202,504 |

) |

| Excess tax benefits from stock-based awards |

|

|

67,634 |

|

|

|

14,490 |

|

|

|

131,648 |

|

|

|

44,715 |

|

| Tax withholdings related to net share settlements of restricted stock awards and restricted stock units |

|

|

(3,644 |

) |

|

|

(2,380 |

) |

|

|

(44,383 |

) |

|

|

(36,049 |

) |

| Other financing activities, net |

|

|

(638 |

) |

|

|

(812 |

) |

|

|

(1,442 |

) |

|

|

(8,333 |

) |

| Net cash used in financing activities |

|

|

(788,579 |

) |

|

|

(574,037 |

) |

|

|

(1,563,821 |

) |

|

|

(1,095,474 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

|

|

52,930 |

|

|

|

(55,378 |

) |

|

|

(7,710 |

) |

|

|

(12,699 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

|

432,235 |

|

|

|

(116,618 |

) |

|

|

340,130 |

|

|

|

(62,208 |

) |

| Cash and cash equivalents, beginning of period |

|

|

1,183,325 |

|

|

|

1,580,837 |

|

|

|

1,275,430 |

|

|

|

1,526,427 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents, end of period |

|

$ |

1,615,560 |

|

|

$ |

1,464,219 |

|

|

$ |

1,615,560 |

|

|

$ |

1,464,219 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yahoo! Inc.

Unaudited Condensed Consolidated Balance Sheets

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

December 31,

2010 |

|

September 30,

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,526,427 |

|

|

$ |

1,464,219 |

|

|

|

|

| Short-term marketable debt securities |

|

|

1,357,661 |

|

|

|

650,593 |

|

|

|

|

| Accounts receivable, net |

|

|

1,028,900 |

|

|

|

872,728 |

|

|

|

|

| Prepaid expenses and other current assets |

|

|

432,560 |

|

|

|

416,809 |

|

|

|

|

| Total current assets |

|

|

4,345,548 |

|

|

|

3,404,349 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term marketable debt securities |

|

|

744,594 |

|

|

|

754,767 |

|

|

|

|

| Property and equipment, net |

|

|

1,653,422 |

|

|

|

1,725,556 |

|

|

|

|

| Goodwill |

|

|

3,681,645 |

|

|

|

3,750,287 |

|

|

|

|

| Intangible assets, net |

|

|

255,870 |

|

|

|

204,680 |

|

|

|

|

| Other long-term assets |

|

|

235,136 |

|

|

|

218,215 |

|

|

|

|

| Investments in equity interests |

|

|

4,011,889 |

|

|

|

4,469,702 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

14,928,104 |

|

|

$ |

14,527,556 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

162,424 |

|

|

$ |

131,473 |

|

|

|

|

| Accrued expenses and other current liabilities |

|

|

1,208,792 |

|

|

|

864,139 |

|

|

|

|

| Deferred revenue |

|

|

254,656 |

|

|

|

205,978 |

|

|

|

|

| Total current liabilities |

|

|

1,625,872 |

|

|

|

1,201,590 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term deferred revenue |

|

|

56,365 |

|

|

|

39,054 |

|

|

|

|

| Capital lease and other long-term liabilities |

|

|

142,799 |

|

|

|

134,310 |

|

|

|

|

| Deferred and other long-term tax liabilities, net |

|

|

506,658 |

|

|

|

647,483 |

|

|

|

|

| Total liabilities |

|

|

2,331,694 |

|

|

|

2,022,437 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Yahoo! Inc. stockholders’ equity |

|

|

12,558,129 |

|

|

|

12,460,109 |

|

|

|

|

| Noncontrolling interests |

|

|

38,281 |

|

|

|

45,010 |

|

|

|

|

| Total equity |

|

|

12,596,410 |

|

|

|

12,505,119 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

$ |

14,928,104 |

|

|

$ |

14,527,556 |

|

|

|

|

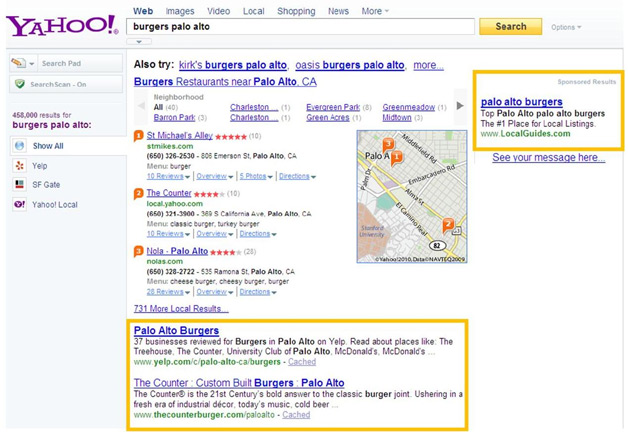

One question Microsoft took on was that of ad positioning between the two search engines. "Your ad rank on Yahoo! and Bing search engine results pages will be the same,"

One question Microsoft took on was that of ad positioning between the two search engines. "Your ad rank on Yahoo! and Bing search engine results pages will be the same,"