The good folks at Modea, a branding and technology agency from Blacksburg, VA, produced this Pinteresting infographic on important Pinterest demographics. (say it five times, fast)

You’ll notice that the majority (68.2%) of users are women. Anyone with a Pinterest account will imediately notice the amount of women’s fashion articles being pinned.

Pinterest could be the fastest growing social media site out there, with a 2,702.2% increase in traffic since last year. The average time users spend on the site is much more than Facebook or Twitter. It even rivals YouTube for time spent. Pretty impressive considering the time commitment it takes to watch a video vs. browsing pictures.

The most interesting thing is the marketing implications this information presents. 28.1% of users have an annual household income exceeding $100,000. 50% of them have children.

Retailers are seeing a huge increase in referral traffic from the site, with a 289% increase from July – Dec. last year, and the amount of traffic is over twice that of LinkedIn, Google+, and YouTube combined.

Another infographic from LinchpinSEO shows the ways in which Businesses are marketing on Pinterest:

Pinterest Marketing” class=”aligncenter” width=”616″ height=”1496″ />

Pinterest Marketing” class=”aligncenter” width=”616″ height=”1496″ />

Photographers and fine artists are showcasing their work on Pinterest with descriptions on where to buy. Wedding planners are taking advantage of the high percentage of women on the site. Businesses are even posting coupons and QR code to drive traffic, build awareness, and ultimately get those high referrals.

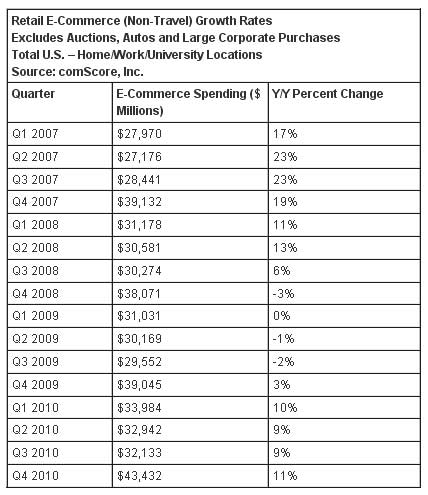

U.S. and European online retail will grow at a 10 percent compound annual growth rate (CAGR) from 2010 to 2015, reaching $279 billion and €134 billion, respectively, in 2015. The forecasts include business-to-consumer sales excluding travel and financial services.

U.S. and European online retail will grow at a 10 percent compound annual growth rate (CAGR) from 2010 to 2015, reaching $279 billion and €134 billion, respectively, in 2015. The forecasts include business-to-consumer sales excluding travel and financial services.

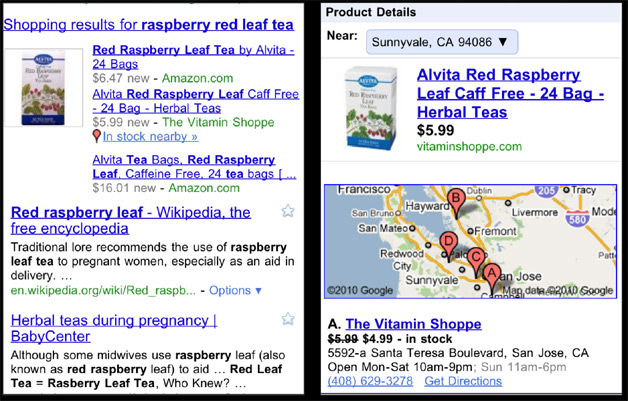

“Mediabrands partners with top retail and CPG brands, and we are committed to investing in resources to develop innovative retail solutions beyond what currently exist in the marketplace today," said Bant Breen, President, Worldwide Digital Communications, Initiative. "AOL has a substantial audience of engaged shoppers that can provide critical insights into what consumers need to enrich their online retail experience. Those same insights can also help marketers create a consistent consumer experience with the local retail store. By partnering with AOL, we can leverage our collective assets in retail, consumer insights and hyper-local to re-invent the category."

“Mediabrands partners with top retail and CPG brands, and we are committed to investing in resources to develop innovative retail solutions beyond what currently exist in the marketplace today," said Bant Breen, President, Worldwide Digital Communications, Initiative. "AOL has a substantial audience of engaged shoppers that can provide critical insights into what consumers need to enrich their online retail experience. Those same insights can also help marketers create a consistent consumer experience with the local retail store. By partnering with AOL, we can leverage our collective assets in retail, consumer insights and hyper-local to re-invent the category."