Stripe has just revealed that it will be offering businesses the capacity to make their own credit cards. The online payments company also announced that they will be using Mastercard and Visa as the operating networks for their new service, aptly called “Stripe Issuing.”

The company explained that the service is “an API for creating cards and new business models” and can be utilized to develop a variety of credit cards, both physical and virtual. For instance, Stripe Issuing can be used to create expense cards with customized credit limits for employees and can even be used by new banks to issue credit cards to their customers.

Since its launch in 2010, Stripe has experienced steady growth in the payments sector. Its system has made it easier for businesses like Lyft, Postmates, and Slack to process payments for ride-sharing, food delivery, and team collaboration services, respectively.

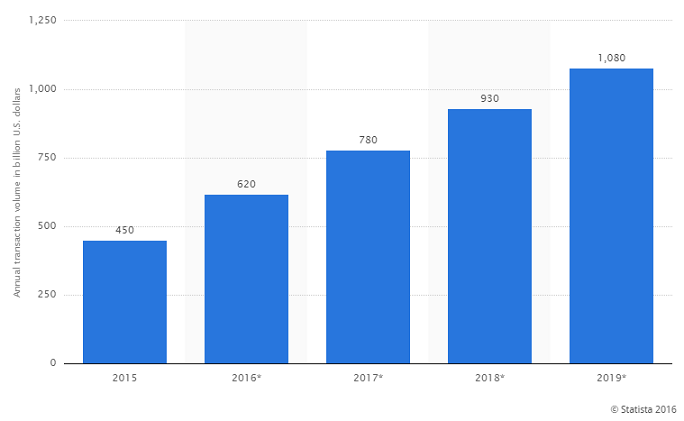

Stripe’s Annual Transaction Volume Since 2015

Now Stripe’s new service aims to fill another gap in payment processing. Lachy Groom, the head of Stripe Issuing, explained to Bloomberg that the company has “tackled many of the major problems on accepting payments” but that businesses still have difficulties in moving their money.

Analyst Jordan McKee expounded on the appeal this new service will have on enterprises. He said that developing a customized payment infrastructure is very complicated and expensive, which is why the majority of companies don’t bother with it. However, Stripe offering a “simplicity value proposition” will definitely bring to light new cases that haven’t been considered previously.

Stripe Issuing service may also generate a tidy sum. Not only will it receive a percentage from every payment made on a card, it could also grow its revenue by retaining customers who are looking for a one-stop source to issue and receive payments.

Dozens of companies have reportedly tested the product, although no names have yet been shared. Businesses who are interested in Stripe’s new service can head over to the company site to request an invitation.

[Featured image via Stripe]