Online spending in the U.S. reached an incredible new high on Cyber Monday, hitting $1.46 Billion for the day, according to comScore. This is the heaviest day of online spending in U.S. history, and follows a record Black Friday for e-commerce.

$16.4 billion has been spent online, this holiday season so far (starting from the beginning of November), according to the firm. That’s a 16% increase from last year. Cyber Monday spending itself was up 17%.

“Despite some news reports suggesting that Cyber Monday might be declining in importance, the day has once again set an online spending record at nearly $1.5 billion,” said comScore chairman Gian Fulgoni. “However, it is also clear that the holiday promotional period has begun even earlier this year, with strong online sales occurring on Thanksgiving Day and Black Friday. Now, we shall see the extent to which continuing and attractive retailer promotions are able to boost sales for the remainder of the week.”

The top product categories for growth on Cyber Monday, compared to last year, were Digital Content & Subscriptions, which grew by 28%, Consumer Electronics, which grew by 25%, Computer Hardware, which grew by 22%, Video Games, Consoles & Accessories, which grew by 18%, and Jewelry & Watches, which grew by 17%.

Interestingly, close to half of dollars spent online at U.S. websites originated from work computers (47.1%), according to comScore. That’s actually down from last year. Buying at U.S. websites from international locations accounted for 5.7% of sales.

“The term ‘Cyber Monday’ was coined by Shop.org in 2005 to refer to the significant jump in e-commerce spending that occurred following the Thanksgiving holiday weekend as consumers got back to sitting in front of computer screens at work,” said Fulgoni. “At the time and for several years afterward, Cyber Monday was often misconstrued as the heaviest online spending day of the year, when in fact it barely cracked the top ten days of the season. However, with the passage of time, the day grew in importance as a result of an increasing number of retailers offering very attractive deals on the day and extensive digital media coverage making sure that consumers were aware of them. As a result, Cyber Monday has assumed the mantle of top online spending day for the past two years – a trend we expect to hold once again in 2012.”

Here’s a comparison of online spending for each week of the holiday season, for this year and the previous four:

Experian Hitwise has put out some data on online retail traffic for Cyber Monday. According to them, traffic increased 11% year-over-year, and the top 500 retail sites received over 206.8 million total U.S. visits. For Black Friday, online retail traffic increased 7% versus 2011 as those sites received over 193.8 million total U.S. visits. On Thanksgiving Day, according to Experian Hitwise, online retail traffic increased 6% versus 2011 as those sites received over 192.5 million total US visits.

“So far this past Holiday week of online traffic from Thanksgiving Day to Cyber Monday to retail sites is up 8% for 2012 vs. 2011,” a spokesperson for the firm tells WebProNews. “Amazon.com remained the top visited retail site on Cyber Monday while Walmart received the second most visits. BestBuy was the 3rd most visited site with Target and JC Penney rounding out the top five.”

“Among the top 5 sites, Amazon saw the biggest year-over-year growth at 36%.Amazon.com was the top visited retail site on Thanksgiving Day, Black Friday and Cyber Monday,” he adds. “Walmart was the #2 site each of those days.”

He also says consumer optimism is at an all-time high for this holiday weekend and retailers could see significant traffic gains for 2012 versus 2011.

“Last year Cyber Monday claimed the prize as the busiest shopping day of the year, growing from 138 million online visits to 177 million total US visits to the top 500 Retail sites, a 29% growth comparing 2011 to 2010,” he says. “Last year, Cyber Monday, Black Friday and Thanksgiving were the top 3 Email Transaction days during the holiday season.”

Online payments giant PayPal saw a 190% increase in global mobile payment volume on Cyber Monday, compared to the same day in 2011. That follows Black Friday, when PayPal saw its biggest mobile shopping day to date, and the company says it saw 44% more payment volume on Cyber Monday than Black Friday. PayPal saw 166% increase in the number of customers shopping with mobile devices on Cyber Monday 2012 as compared to last year. Shoppers in Houston, Miami, Los Angeles, Chicago and New York made the most purchases through PayPal on Cyber Monday this year.

Cyber Monday was pretty huge for Etsy too.

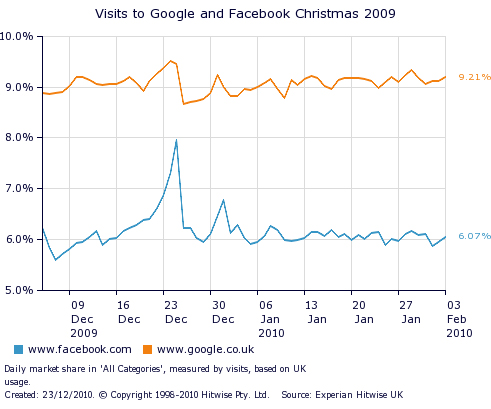

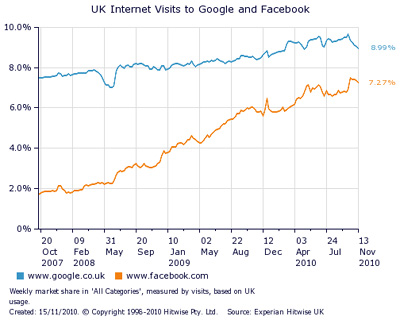

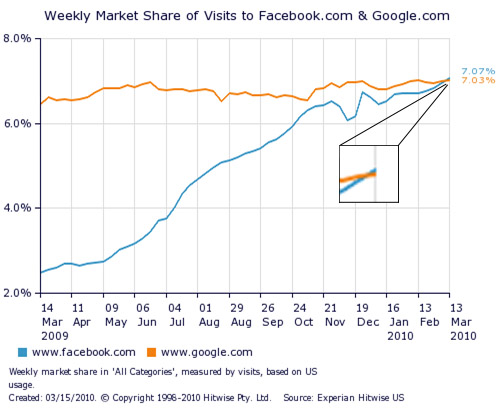

And now, the Googler Supreme, Matt Cutts, has thrown his two cents into the fray. Needless to say, he didn’t agree with Hitwise’s “conclusion” either.

And now, the Googler Supreme, Matt Cutts, has thrown his two cents into the fray. Needless to say, he didn’t agree with Hitwise’s “conclusion” either.