Google Wallet has come a long way over the past year, and this week in particular, made perhaps its most significant move towards becoming a truly major way to pay for goods and services.

On Wednesday, Google unveiled the Google Wallet Card, a physical card that consumers can use to pay for things in stores using their Google accounts.

Do you currently use Google Wallet? Do you trust Google with your money? Do you think the Google Wallet Card is going to catch on? Share your thoughts in the comments.

The card is free. That’s a key. If you have a Google Wallet account, you can get a card. Pretty simple. So right off the bat, there’s very little friction in at least getting these in users’ hands (or Wallets, if you will).

Google suggests that a friend could pay you back money you lent them using Google Wallet, and then turn around and use that money (via your Google Wallet Card) at the store to buy groceries. Just one example of where this card could come in handy.

Google Wallet product manager Sandra Mariano explains, “Now, you can use the new Google Wallet Card to spend the money instantly, either by purchasing in stores or by withdrawing cash at ATMs, without having to wait for money to transfer from your Google Wallet Balance to your bank account. The Google Wallet Card is a debit card that lets you quickly access your Wallet Balance, whether you’ve received it from a friend or added it directly from a linked bank account or credit/debit card.”

The card can be used anywhere in the U.S. (so far) where MasterCard is accepted.

“And don’t forget, there are many ways of spending your Wallet Balance in addition to spending it with the Google Wallet Card,” says Mariano. “You can use your Wallet Balance to send money to friends, purchase on Google Play, YouTube and other products, tap and pay in stores, or transfer money to your bank account.”

And that’s the thing. Google has already integrated Google Wallet all over the place, particularly on Google services (and I’m guessing you use one or two of those). There’s a good chance you already have this account (even less friction).

As you probably know, Google Wallet took over for Google Checkout, which launched all the way back in 2006. Google has had about seven years to get Google Wallet accounts racked up. Obviously many sites around the web accept Google payments.

Checkout officially shut down this past week. If you have been using Google Checkout as a payment option on your site, and haven’t prepared for the change, you might want to watch this video.

Another big feature Google launched this year was the integration of Google Wallet into Gmail, enabling users to send payments by email, similar to Square Cash, but more limited in some ways.

You can also now book hotels with Google Wallet, using Google’s Hotel Finder.

A major component of Google Wallet is its ability to simplify the buying process on mobile. A few months back, Google launched the Google Wallet “Instant Buy” API aimed at helping businesses decrease abandonment rates on mobile devices. According to the company at the time, the abandonment rate of shopping carts on mobile is a whopping 97%.

The Verge hailed the move as “a big play from Google to take its payment service to mobile in a subtle way,” and that’s pretty much a perfect way of putting it.

“The Instant Buy API is designed for merchants and developers selling physical goods and services, who already have a payment processor and are looking to simplify the checkout experience for their customers,” explained Google’s Prakash Hariramani. “Developers selling digital goods within their apps will continue to use Google Play In-app Billing, which offers full payment processing capability, including support for carrier billing and gift cards.”

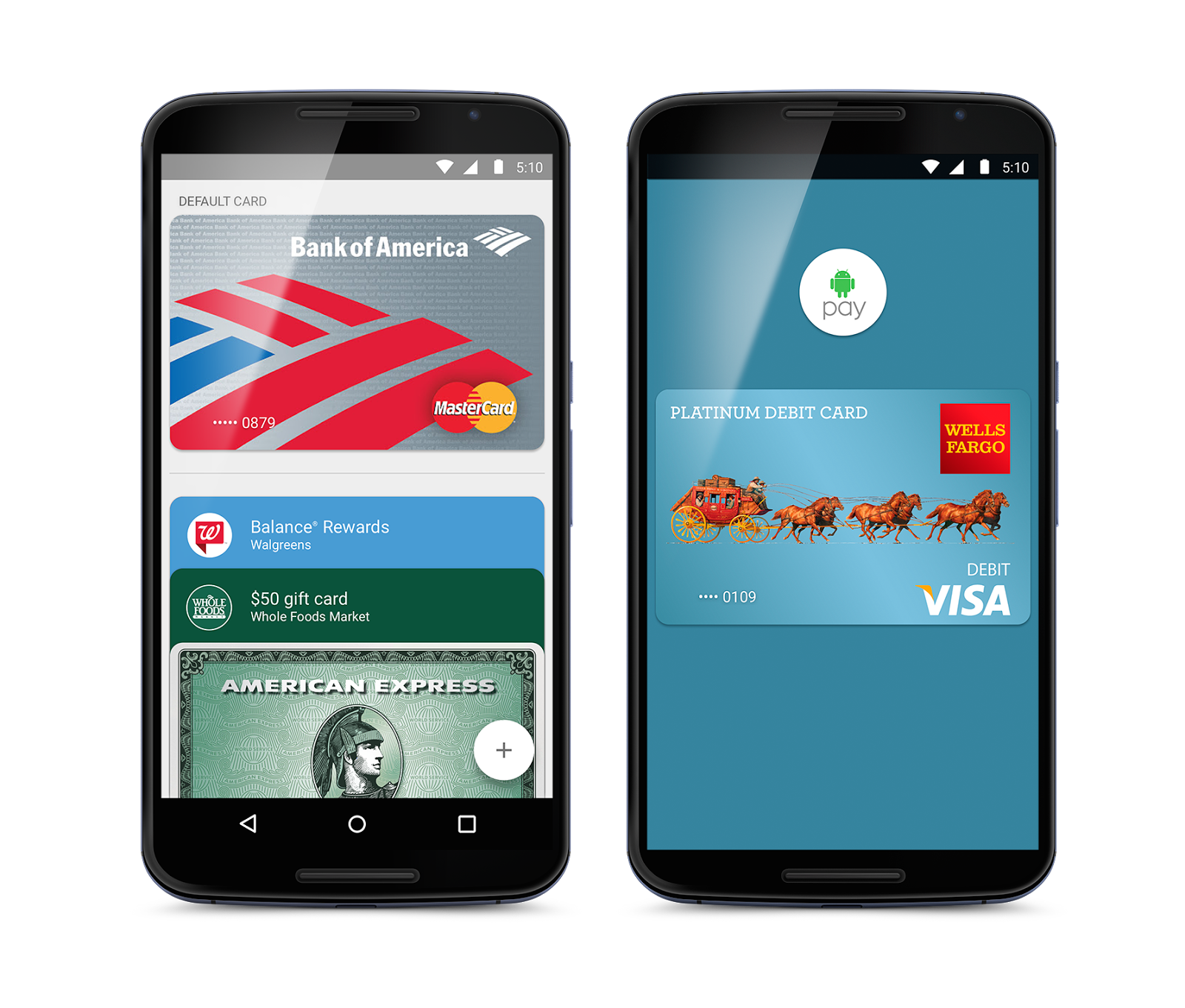

This week, in addition to launching the Google Wallet Card, Google updated the Android app, enabling users to easily add funds to their accounts by taking pictures of their credit and debit cards. It will capture the number and the expiration date automatically.

A lot of banks already let you deposit checks this way with their mobile apps. How long until you can simply deposit checks into your Google Wallet account?

The app also now includes a button you can click on to order your Google Wallet Card.

As far as adoption goes, Google Wallet only launched for the iPhone two months ago, so that should help it gain some traction. This followed another major update for the Android app, which brought some new loyalty programs with it, as well as the aforementioned email payment method. The iPhone version also includes these.

Google is often in the news for privacy-related issues, and it stands to reason that some people won’t trust Google with their money. The company just settled with 37 states over Safari user tracking, and even more recently, a German court ruled that Google’s privacy policy violates data protection law.

Earlier this year, it was revealed that Google Play was sending personal details to developers when users bought their apps on the Play Store. Congress even got involved, and then Google responded by updating Google Wallet to remove personally identifiable information from transactions.

People will no doubt be wondering if Google is using their Wallet Card transactions for other purposes. Keep in mind recent reports that Google is testing tacking consumers through the physical world to give data to advertisers. That’s with smartphones. With the Wallet Card, Google has found yet another way into your pocket.

Google has shown it is taking payments seriously with a series of aggressive moves in 2013. I expect we’ll be seeing quite a few more over the coming year.

Google had an April Fools’ joke this year about launching the Google Wallet Mobile ATM that you can plug into your smartphone and get cash.

I don’t know if we’ll be seeing anything quite that revolutionary from Google Wallet anytime soon, but Google obviously has some interesting ideas.

So how about it? Are you going to be a Google Wallet Card carrier? Do you use Google Wallet for any kind of transaction on a regular or non-regular basis? Tell us about how you use it or why you don’t.