Have a John Mayer fan in your life? Not sure what to get them for Christmas? Well here’s an early Christmas gift idea, and it could be quite cheap too!

On Monday, Mayer took to his Instagram to announce a photo contest.

The soulful singer posted, “Submit pictures with #BKLOVESMAYER to enter a flyaway contest to JM’s show in Brooklyn on 12/17 courtesy of Citi Private Pass. Show us who/what you love! www.billboard.com/BKLovesMayer,” with the following photo.

The photo contest with Billboard magazine is in support of Mayer’s Fall 2013 tour with Citi. The inspiration for this contest is Mayer’s latest single, “Who You Love.”

From November 7 to November 26, fans have a chance to share a photo and explain who or what they love on Instagram with the hashtag #BKLovesMayer. The winner will be chosen in early December and will then be flown to Brooklyn, New York, meet the Grammy Award-winning Mayer and then get to see him in concert at the Barclays Center on December 17.

Mayer fans can also enter for a chance to win a signed copy of his latest album, Paradise Valley. Just visit the website billboard.com/bklovesmayer and go through the photos already posted by fans with the hashtag #BKLovesMayer. Once you have chosen your favorite two, put them side-by-side and post them to the websites gallery. Five winners will then be chosen to win a signed copy of Paradise Valley.

Fans of Mayer have already taken to their Instagram to post photos of who/what they love.

One woman posted a photo of her daughter saying, “I love my daughter who is traveling around the world to serve the least and the lost#BKLOVESMAYER#the worldrace#11n11”

Another fan loves the fact that Mayer and Katy Perry are a couple.

“My two favorite singers!!! #bklovesmayer #matchmadeinheaven”

While another fan posted she loves being a part of her family.

So get on over to Instagram and let John Mayer know who or what you love! (Of course, if you’re not a John Mayer fan, do something else.)

[Image via YouTube.]

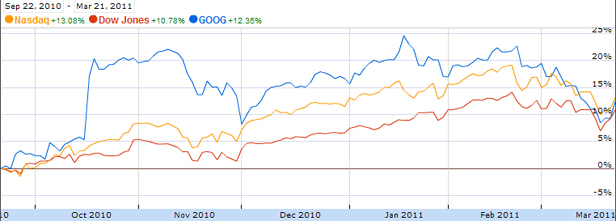

Google’s suffered a lot of small defeats like this in recent weeks and months. Two of our last four articles relating to both Google and money touch on estimates getting cut, in fact, with a third noting when the company’s shares sank below $500. (The fourth just discusses how Google is using financial experts to manage its war chest.)

Google’s suffered a lot of small defeats like this in recent weeks and months. Two of our last four articles relating to both Google and money touch on estimates getting cut, in fact, with a third noting when the company’s shares sank below $500. (The fourth just discusses how Google is using financial experts to manage its war chest.)