The Strategic Organizing Center (SOC) has written the Federal Trade Commission, asking the agency to block Amazon’s MGM purchase.

The SOC represents four unions: the Service Employees International Union, the International Brotherhood of Teamsters, the Communications Workers of America and the United Farmworkers. Together, the four unions include some 4 million workers.

The SOC has written an open letter to Ms. Holly Vedova, the FTC’s Acting Director, Bureau of Competition, expressing concerns over Amazon’s proposed purchase of MGM Studios, valued at $8.45 billion.

The letter highlights the current state of the streaming video-on-demand (SVOD) market, a market Amazon is uniquely poised to gain an unfair advantage in.

The SVOD market is in the midst of both massive expansion and increasing vertical integration. The market is currently dominated by an oligopoly of five firms. In 2020, Netflix (20%), Amazon Prime Video (16%), Hulu (13%), HBO Max (12%), and Disney+ (11%) collectively comprised 72 percent of the entire US SVOD market.1 Each of these firms operate their own studios as well as a streaming platform which acts as distribution channel for content they choose to acquire, or, increasingly, that they produce themselves.

The letter goes on to highlight that Amazon’s dominance in other markets, specifically e-commerce, allows the company to offer its SVOD services for free, putting it in a position to abuse its market power.

Amazon’s Prime membership – which bundles free, expedited delivery with streaming video at no additional cost to consumers – is radically different from the per-month-fee model implemented by SVOD competitors. This model, which has already drawn the attention of competition authorities in Europe, involves an aggressive pricing strategy that unfairly leverages Amazon’s dominance in e- commerce into the SVOD market by offering streaming content at no cost to consumers.

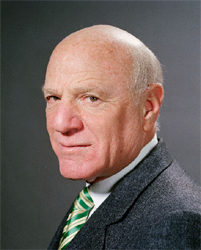

The letter quotes former studio exec Barry Diller’s assessment of the deal to sum up the SOC’s objections.

“[When I ran studios] the key point of movies was to please consumers,” but for a service like Amazon Prime “incentives have changed … The system is not necessarily to please anybody. It is to buy more Amazon stuff.”

The SOC’s opposition to Amazon’s MGM deal is just the latest challenge the company is facing amid increasing antitrust scrutiny.

Diller, an industry legend, isn’t leaving the company, in any event; he’ll now act as "Chairman and Senior Executive." Also, Diller intends to purchase enough stock over the next nine months to increase his voting share to more than 40 percent, so it’s not like he’ll be an important figure in name only.

Diller, an industry legend, isn’t leaving the company, in any event; he’ll now act as "Chairman and Senior Executive." Also, Diller intends to purchase enough stock over the next nine months to increase his voting share to more than 40 percent, so it’s not like he’ll be an important figure in name only.