Investors weren’t thrilled with Etsy’s Q3 report when the company posted a net loss of $6.9 million ( 6 cents per share) and revenue of $65.7 million. On Tuesday, the company posted its Q4 and full-year 2015 financials with a much better reaction as shares quickly went upward.

Etsy posted a Q4 adjusted loss of $0.04 per share and revenue of $87.8 million, which was higher than Wall Street projections.

“We are proud of our progress in 2015. We hit many important milestones that are the building blocks for long-term, sustainable growth,” said CEO Chad Dickerson. “We executed against our strategic priorities, particularly in mobile, where we began to narrow the gap between mobile visits and mobile GMS. We also enhanced our existing seller services and continued to bring new constituents into the Etsy Economy. All of this activity allowed Etsy to generate $2.4 billion in GMS in 2015 and support approximately 1.6 million active sellers and more than 24.0 million active buyers. In 2016, we remain committed to reimagining commerce and are focused on launching more products and services that will allow us to build long-term value for our community.”

The company provided three-year financial guidance.

CFO Kristina Salen said, “We believe Etsy has significant opportunity ahead and we remain committed to delivering long-term, sustainable growth to all our stakeholders. One of our key values at Etsy is open and transparent communication. In that spirit, we are providing this additional long-term guidance to better demonstrate how we believe our strategic initiatives will translate to our financial results over the next three years.”

Find the full release below:

BROOKLYN, N.Y., Feb. 23, 2016 /PRNewswire/ — Etsy, Inc. (NASDAQ: ETSY), a marketplace where people around the world connect, both online and offline, to make, sell and buy unique goods, today announced financial results for its fourth quarter and full year ended December 31, 2015.

“We are proud of our progress in 2015. We hit many important milestones that are the building blocks for long-term, sustainable growth,” said Chad Dickerson, Etsy, Inc. CEO and Chairman. “We executed against our strategic priorities, particularly in mobile, where we began to narrow the gap between mobile visits and mobile GMS. We also enhanced our existing seller services and continued to bring new constituents into the Etsy Economy. All of this activity allowed Etsy to generate $2.4 billion in GMS in 2015 and support approximately 1.6 million active sellers and more than 24.0 million active buyers. In 2016, we remain committed to reimagining commerce and are focused on launching more products and services that will allow us to build long-term value for our community.”

| Fourth Quarter 2015 Financial Summary

(in thousands) |

|

|

Three Months Ended

December 31, |

|

% Growth Y/Y |

|

Year Ended

December 31, |

|

% Growth Y/Y |

|

2014 |

|

2015 |

|

|

|

2014 |

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GMS |

$ |

611,474 |

|

|

$ |

741,488 |

|

|

21.3 |

% |

|

$ |

1,931,981 |

|

|

$ |

2,388,387 |

|

|

23.6 |

% |

| Revenue |

$ |

64,912 |

|

|

$ |

87,895 |

|

|

35.4 |

% |

|

$ |

195,591 |

|

|

$ |

273,499 |

|

|

39.8 |

% |

| Marketplace revenue |

$ |

33,311 |

|

|

$ |

39,796 |

|

|

19.5 |

% |

|

$ |

108,732 |

|

|

$ |

132,648 |

|

|

22.0 |

% |

| Seller Services revenue |

$ |

30,690 |

|

|

$ |

47,230 |

|

|

53.9 |

% |

|

$ |

82,502 |

|

|

$ |

136,608 |

|

|

65.6 |

% |

| Adjusted EBITDA |

$ |

9,298 |

|

|

$ |

14,049 |

|

|

51.1 |

% |

|

$ |

23,081 |

|

|

$ |

31,007 |

|

|

34.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Active sellers |

1,353 |

|

|

1,563 |

|

|

15.5 |

% |

|

1,353 |

|

|

1,563 |

|

|

15.5 |

% |

| Active buyers |

19,810 |

|

|

24,046 |

|

|

21.4 |

% |

|

19,810 |

|

|

24,046 |

|

|

21.4 |

% |

| Percent mobile visits |

56 |

% |

|

61 |

% |

|

500 |

bps |

|

54 |

% |

|

60 |

% |

|

600 |

bps |

| Percent mobile GMS |

38 |

% |

|

44 |

% |

|

600 |

bps |

|

37 |

% |

|

43 |

% |

|

600 |

bps |

| Percent international GMS |

30.6 |

% |

|

29.2 |

% |

|

(140) |

bps |

|

30.9 |

% |

|

29.8 |

% |

|

(110) |

bps |

For information about how we define these metrics, see our Quarterly Report on Form 10-Q for the quarter ended September 30, 2015 filed with the SEC on November 5, 2015.

Fourth Quarter 2015 Operational Highlights

GMS was $741.5 million, up 21.3% compared with the fourth quarter of 2014. Growth in GMS was driven by 15.5% year-over-year growth in active sellers and 21.4% year-over-year growth in active buyers. Continuing the trend we’ve seen for multiple quarters, mobile visits once again grew faster than desktop visits and, for the second consecutive quarter, we narrowed the gap between mobile visits and mobile GMS. Percent mobile visits was approximately 61% compared with approximately 56% in the fourth quarter of 2014 and percent mobile GMS was approximately 44% compared with approximately 38% in the fourth quarter of 2014. Throughout 2015, we continued to enhance our buyer mobile apps in many ways such as adding new deeplinking functionality, integrating social sign-up and sign-in, and expanding our mobile payment and digital wallet options with Apple Pay® and Google Wallet™. We believe this work strengthened our mobile footprint and contributed to our strong year-over-year GMS growth on our buyer mobile app, which further narrowed the gap between mobile visits and mobile GMS during the fourth quarter.

We continue to believe that we can grow international GMS, over time, to represent 50% of our total GMS and that the impact of currency exchange rates contributed to the year-over-year decline in percent international GMS, which was 29.2% in the fourth quarter of 2015. Percent international GMS was 29.3% in the third quarter of this year.

We believe that our GMS growth and percent international GMS are impacted by currency exchange rates in two ways. First, approximately 11% of our GMS comes from goods that are not listed in U.S. dollars and, as a result, is subject to the impact of currency exchange fluctuations. The percentage of GMS from goods that are not listed in U.S. dollars is slightly higher than what we reported in the third quarter of 2015. Excluding this direct impact, on a currency-neutral basis, GMS growth in the fourth quarter of 2015 would have been 22.7%, or approximately 1.4 percentage points higher than the as-reported 21.3% growth.

Second, we believe weaker local currencies in key international markets continued to dampen the demand for U.S. dollar-denominated goods during the fourth quarter of 2015. For example, during the fourth quarter of 2015, GMS from international buyers purchasing from U.S. sellers declined approximately 13% year-over-year, compared with an approximately 13% and 6% year-over-year decline in the third and second quarters of 2015, approximately flat year-over-year performance in the first quarter of 2015, and approximately 23% and 44% year-over-year growth in the fourth and third quarters of 2014 respectively. In contrast, excluding our French marketplace ALM, GMS from international buyers making purchases from sellers in their own country grew approximately 49% year-over-year during the fourth quarter of 2015.

Taken together, we estimate that the impact of currency translation on goods not listed in U.S. dollars and the impact of currency exchange rates on international buyer behavior reduced our year-over-year GMS growth rate by approximately two percentage points in the fourth quarter.

Fourth Quarter 2015 Financial Highlights

Total revenue was $87.9 million, up 35.4% year-over-year, driven by growth in both Marketplace and Seller Services revenue. Marketplace revenue grew 19.5%, primarily due to growth in transaction fee revenue and, to a lesser extent, growth in listing fee revenue. Seller Services revenue grew 53.9% year-over-year, due to growth in revenue from both Direct Checkout, which benefited from the integration of PayPal early in the fourth quarter, and Promoted Listings, which grew at a slightly lower rate than Direct Checkout. Seller Services revenue also benefited from growth in revenue from Shipping Labels, which continued to grow faster than Marketplace revenue in the fourth quarter.

Gross profit for the fourth quarter was $57.7 million, up 36.9% year-over-year, and gross margin was 65.6%, up 70 bps compared with 64.9% in the fourth quarter of 2014. Similar to the first, second and third quarters of 2015, gross profit grew faster than revenue in the fourth quarter because of the leverage we achieved in employee-related and hosting and bandwidth-related costs as well as the continued strong growth of Promoted Listings, a higher-margin revenue stream.

Total operating expenses were $49.3 million in the fourth quarter, up 17.5% year-over-year. Total operating expenses as a percent of revenue declined to 56.1% in the fourth quarter of 2015 compared with 64.6% in the fourth quarter of 2014, as revenue growth continued to outpace operating expense growth.

The overall increase in operating expenses was primarily driven by the planned increase in reported marketing expenses, which grew 53.8% year-over-year mostly due to increased spending on digital marketing, which is currently focused on product listing ads. The year-over-year growth rate in fourth quarter marketing expenses decelerated relative to the growth rate of marketing expenses during the fourth quarter of 2014, which was 95.5%.

Product development expenses grew 15.3% year-over-year, primarily due to higher employee-related expenses. G&A expenses decreased 11.5% year-over-year. The year-over-year reduction in G&A expenses reflects the favorable impact of a mark-to-market adjustment related to ALM stock-based compensation and a reduction in bad debt expense.

Non-GAAP Adjusted EBITDA for the fourth quarter was $14.0 million and grew 51.1% year-over-year. Adjusted EBITDA margin was 16.0%, up 170 bps year-over-year.

Net loss for the fourth quarter of 2015 was $4.2 million, compared with a $5.4 million net loss in the fourth quarter of 2014. Etsy’s net loss in the fourth quarter of 2015 was impacted by a foreign exchange loss and our income tax provision. We recorded $6.0 million of foreign exchange loss in the fourth quarter of 2015 largely made up of a non-cash currency loss related to the revised global corporate structure that we implemented on January 1, 2015. We also recorded a $6.3 million tax provision in the fourth quarter of 2015 primarily driven by non-cash charges related to our revised global corporate structure.

Net cash provided by operating activities was $10.2 million in the fourth quarter of 2015 compared with $0.1 million in the fourth quarter of 2014. The increase in net cash provided by operating activities for the quarter was mainly due to the timing of payments to certain vendors.

Cash, marketable securities and short-term investments were $292.9 million as of December 31, 2015.

3-Year Financial Guidance

“We believe Etsy has significant opportunity ahead and we remain committed to delivering long-term, sustainable growth to all our stakeholders. One of our key values at Etsy is open and transparent communication. In that spirit, we are providing this additional long-term guidance to better demonstrate how we believe our strategic initiatives will translate to our financial results over the next three years,” said Kristina Salen, Etsy, Inc. CFO.

Over the next three years we believe we can deliver solid revenue growth and achieve leverage in our cost structure to expand our margins.

|

|

2016-2018 CAGR Range |

|

2016 Guidance |

| GMS Growth |

|

13-17% |

|

Mid-point of range |

| Revenue Growth |

|

20-25% |

|

High end of the range |

| Gross Margin

(by 2018) |

|

Mid 60s (%) |

|

64-65% |

| Adjusted EBITDA Margin

(by 2018) |

|

High teens (%) |

|

10-11% |

- We expect to achieve a three-year revenue CAGR in the 20-25% range and a three-year GMS CAGR in the 13-17% range. In 2016, we expect revenue growth to be at the high end of our three-year range and GMS growth to be near the mid-point of our three-year range. We anticipate that the key factors impacting revenue and GMS growth over the next three years include:

- Further narrowing of the gap between mobile visits and mobile GMS

- Stable percent international GMS, assuming that currency remains stable compared to average levels in December 2015

- Continued revenue growth in our existing seller services, driven by both adoption and product enhancements

- Modest contributions from new product launches and seller services

- We expect to exit 2018 with a full-year gross margin that is in the mid-60s percent range, and that 2016 gross margin will be in this range as well. We anticipate that the key factors impacting our gross margin forecast over the next three years include:

- Continued revenue growth in our existing seller services, driven by both adoption and product enhancements

- The impact from new seller services that we intend to launch

- We also expect to gain leverage in our operating cost structure over the next three years, particularly within marketing spend.

- In 2016, we expect marketing expense as a percent of revenue to decline, but that overall operating expenses as a percent of revenue will increase driven by expenses associated with our new headquarters and with Sarbanes-Oxley compliance.

- Finally, from an Adjusted EBITDA margin perspective, we estimate that our margin in 2016 will be comparable to 2015 in the 10-11% range and that it will expand to the high teens range by the end of 2018.

Webcast and Conference Call Replay Information

Etsy will host a webcast to discuss these results at 5:30 p.m. ET today. To access the live webcast, please visit the Etsy Investor Relations website, investors.etsy.com and go to the Investor Events section.

A replay will be available following the live webcast and may be accessed on the same website. A telephonic replay will also be available through midnight ET on March 8, 2016 at (855) 859-2056 or (404) 537-3406; conference ID 44052221.

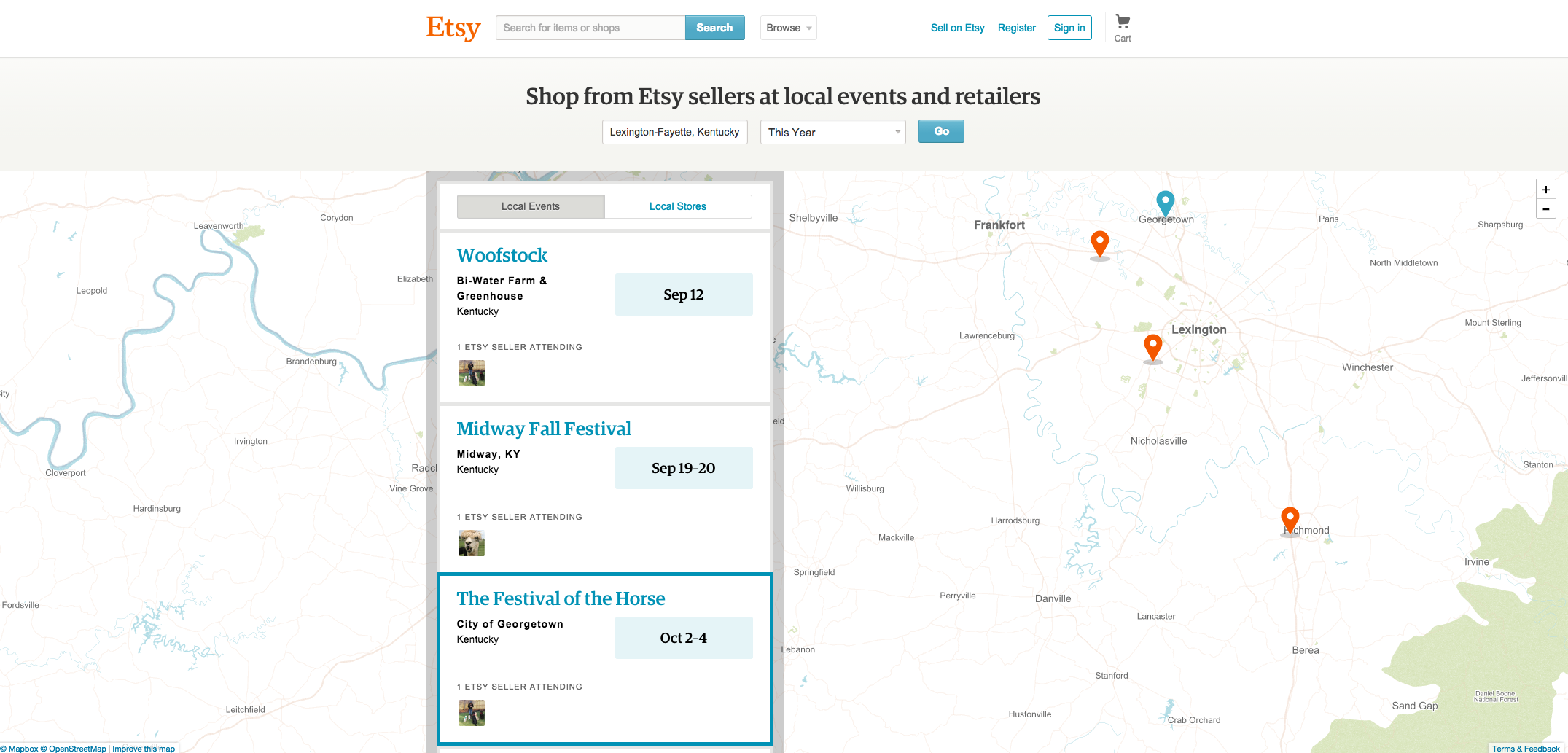

About Etsy

Etsy is a marketplace where millions of people around the world connect, both online and offline, to make, sell and buy unique goods. The Etsy community includes the creative entrepreneurs who sell on our platform, thoughtful consumers looking to buy unique goods in our marketplace, retailers and manufacturers who partner with Etsy sellers to help them grow their businesses, and Etsy employees who maintain our platform and nurture our ecosystem. Our mission is to reimagine commerce in ways that build a more fulfilling and lasting world, and we’re committed to using the power of business to strengthen communities and empower people.

Etsy was founded in 2005 and is headquartered in Brooklyn, New York.

Investor Relations Contact:

Etsy, Jennifer Beugelmans, [email protected]

Media Relations Contact:

Etsy, Kelly Clausen, [email protected]

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include information related to our possible or assumed future results of operations and expenses, our financial guidance, our mission, business strategies and plans, business environment and future growth. Forward-looking statements include all statements that are not historical facts. In some cases, forward-looking statements can be identified by words such as “believes,” “expects,” “may,” “plans,” “should,” “will,” “intends,” or similar expressions and the negatives of those words.

Forward-looking statements involve substantial risks and uncertainties that may cause actual results to differ materially from those that we expect. These risks and uncertainties include (i) our history of operating losses; (ii) the fluctuation of our quarterly operating results; (iii) adherence to our values and our focus on long-term sustainability, which may negatively influence our short- or medium-term financial performance; (iv) the importance to our success of the trustworthiness of our marketplace and the connections within our community; (v) our ability to expand successfully into markets outside of the United States; (vi) increases in our marketing efforts to help grow our business, which may not be effective at attracting and retaining Etsy sellers and buyers; (vii) our payments system, which depends on third-party providers and is subject to evolving laws and regulations; (viii) our ability to add new members to our community, grow our ecosystem and open new sales channels for Etsysellers; (ix) our ability to develop new offerings to respond to the changing needs of Etsy sellers and buyers; (x) the effectiveness of our mobile solutions for Etsy sellers and Etsy buyers; and (xi) our ability to compete effectively. These risks and uncertainties are more fully described in our filings with the Securities and Exchange Commission, including in the section entitled “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2015.

Forward-looking statements represent our beliefs and assumptions only as of the date of this press release. We disclaim any obligation to update these forward-looking statements.

| Etsy, Inc.

Condensed Consolidated Balance Sheets

(in thousands, unaudited) |

|

|

As of

December 31,

2014 |

|

As of

December 31,

2015 |

|

|

|

|

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

69,659 |

|

|

$ |

271,244 |

|

| Short-term investments |

19,184 |

|

|

21,620 |

|

| Accounts receivable, net |

15,404 |

|

|

20,275 |

|

| Prepaid and other current assets |

12,241 |

|

|

9,521 |

|

| Deferred tax charge—current |

— |

|

|

17,132 |

|

| Funds receivable and seller accounts |

10,573 |

|

|

19,262 |

|

| Total current assets |

127,061 |

|

|

359,054 |

|

| Restricted cash |

5,341 |

|

|

5,341 |

|

| Property and equipment, net |

75,538 |

|

|

105,021 |

|

| Goodwill |

30,831 |

|

|

27,752 |

|

| Intangible assets, net |

5,410 |

|

|

2,871 |

|

| Deferred tax charge—net of current portion |

— |

|

|

51,396 |

|

| Other assets |

2,022 |

|

|

1,626 |

|

| Total assets |

$ |

246,203 |

|

|

$ |

553,061 |

|

| LIABILITIES, CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

8,231 |

|

|

$ |

14,382 |

|

| Accrued expenses |

12,852 |

|

|

31,253 |

|

| Capital lease obligations—current |

1,755 |

|

|

5,610 |

|

| Funds payable and amounts due to sellers |

10,573 |

|

|

19,262 |

|

| Deferred revenue |

3,452 |

|

|

4,712 |

|

| Other current liabilities |

4,590 |

|

|

4,903 |

|

| Total current liabilities |

41,453 |

|

|

80,122 |

|

| Capital lease obligations—net of current portion |

3,148 |

|

|

7,571 |

|

| Warrant liability |

1,920 |

|

|

— |

|

| Deferred tax liabilities |

149 |

|

|

61,420 |

|

| Facility financing obligation |

50,320 |

|

|

51,804 |

|

| Other liabilities |

1,913 |

|

|

21,646 |

|

| Total liabilities |

98,903 |

|

|

222,563 |

|

| Total convertible preferred stock |

80,212 |

|

|

— |

|

| Total stockholders’ equity |

67,088 |

|

|

330,498 |

|

| Total liabilities, convertible preferred stock and stockholders’ equity |

$ |

246,203 |

|

|

$ |

553,061 |

|

| Etsy, Inc.

Condensed Consolidated Statements of Operations

(in thousands except share and per share data, unaudited) |

|

|

Three Months Ended

December 31, |

|

Year Ended

December 31, |

|

2014 |

|

2015 |

|

2014 |

|

2015 |

|

|

|

|

|

|

|

|

| Revenue |

$ |

64,912 |

|

|

$ |

87,895 |

|

|

$ |

195,591 |

|

|

$ |

273,499 |

|

| Cost of revenue |

22,779 |

|

|

30,196 |

|

|

73,633 |

|

|

96,979 |

|

| Gross profit |

42,133 |

|

|

57,699 |

|

|

121,958 |

|

|

176,520 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Marketing |

14,613 |

|

|

22,476 |

|

|

39,655 |

|

|

66,771 |

|

| Product development |

9,723 |

|

|

11,207 |

|

|

36,634 |

|

|

42,694 |

|

| General and administrative |

17,621 |

|

|

15,600 |

|

|

51,920 |

|

|

68,939 |

|

| Total operating expenses |

41,957 |

|

|

49,283 |

|

|

128,209 |

|

|

178,404 |

|

| Income (loss) from operations |

176 |

|

|

8,416 |

|

|

(6,251) |

|

|

(1,884) |

|

| Total other expense |

(2,431) |

|

|

(6,308) |

|

|

(4,009) |

|

|

(26,110) |

|

| (Loss) income before income taxes |

(2,255) |

|

|

2,108 |

|

|

(10,260) |

|

|

(27,994) |

|

| Provision for income taxes |

(3,103) |

|

|

(6,340) |

|

|

(4,983) |

|

|

(26,069) |

|

| Net loss |

$ |

(5,358) |

|

|

$ |

(4,232) |

|

|

$ |

(15,243) |

|

|

$ |

(54,063) |

|

| Net loss per share—basic and diluted |

$ |

(0.12) |

|

|

$ |

(0.04) |

|

|

$ |

(0.38) |

|

|

$ |

(0.59) |

|

| Weighted average common shares outstanding—basic and diluted |

43,177,805 |

|

|

111,677,599 |

|

|

40,246,663 |

|

|

91,122,291 |

|

| Etsy, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands, unaudited) |

|

|

Year Ended

December 31, |

|

2014 |

|

2015 |

|

|

|

|

| Cash flows from operating activities |

|

|

|

| Net loss |

$ |

(15,243) |

|

|

$ |

(54,063) |

|

| Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

| Stock-based compensation expense |

5,920 |

|

|

8,981 |

|

| Stock-based compensation expense-acquisitions |

4,130 |

|

|

1,860 |

|

| Contribution of stock to Etsy.org |

— |

|

|

3,200 |

|

| Depreciation and amortization expense |

17,223 |

|

|

18,550 |

|

| Bad debt expense |

1,881 |

|

|

1,780 |

|

| Foreign exchange loss |

3,049 |

|

|

21,775 |

|

| Amortization of debt issuance costs |

68 |

|

|

167 |

|

| Net unrealized loss on warrant and other liabilities |

411 |

|

|

3,133 |

|

| Loss on disposal of assets |

79 |

|

|

1,319 |

|

| Amortization of deferred tax charges |

— |

|

|

17,132 |

|

| Excess tax benefit from exercise of stock options |

(4,877) |

|

|

(3,944) |

|

| Changes in operating assets and liabilities, net of acquisitions |

(554) |

|

|

9,321 |

|

| Net cash provided by operating activities |

12,087 |

|

|

29,211 |

|

| Cash flows from investing activities |

|

|

|

| Acquisition of businesses, net of cash acquired |

(4,688) |

|

|

— |

|

| Purchases of property and equipment |

(1,304) |

|

|

(11,116) |

|

| Development of internal-use software |

(8,280) |

|

|

(9,719) |

|

| Purchase of U.S. Government and agency bills |

(21,698) |

|

|

(26,040) |

|

| Sale of marketable securities |

20,588 |

|

|

23,592 |

|

| Net increase in restricted cash |

(5,341) |

|

|

— |

|

| Net cash used in investing activities |

(20,723) |

|

|

(23,283) |

|

| Cash flows from financing activities |

|

|

|

| Proceeds from public offering |

— |

|

|

199,467 |

|

| Proceeds from the issuance of common stock |

35,000 |

|

|

— |

|

| Proceeds from exercise of stock options |

7,956 |

|

|

3,626 |

|

| Excess tax benefit from the exercise of stock options |

4,877 |

|

|

3,944 |

|

| Payments on capitalized lease obligations |

(1,480) |

|

|

(3,377) |

|

| Deferred payments on acquisition of business |

(75) |

|

|

— |

|

| Payments relating to public offering |

(1,041) |

|

|

(4,052) |

|

| Net cash provided by financing activities |

45,237 |

|

|

199,608 |

|

| Effect of exchange rate changes on cash |

(3,737) |

|

|

(3,951) |

|

| Net increase in cash and cash equivalents |

32,864 |

|

|

201,585 |

|

| Cash and cash equivalents at beginning of period |

36,795 |

|

|

69,659 |

|

| Cash and cash equivalents at end of period |

$ |

69,659 |

|

|

$ |

271,244 |

|

Use of Non-GAAP Financial Measures

In this press release, we provide Adjusted EBITDA, a non-GAAP financial measure that represents our net loss before interest expense, net, provision for income taxes and depreciation and amortization, adjusted to eliminate stock-based compensation expense, net unrealized loss on warrant and other liabilities, foreign exchange loss, other non-operating expense, net, contributions to Etsy.org and acquisition-related expenses. Following is a reconciliation of Adjusted EBITDA to net loss, the most directly comparable GAAP financial measure.

We have included Adjusted EBITDA in this press release because it is a key measure used by our management and board of directors to evaluate our operating performance and trends, allocate internal resources, prepare and approve our annual budget, develop short- and long-term operating plans and assess the health of our business. As our Adjusted EBITDA increases, we are able to invest more in our platform. We believe that Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our business as it removes the impact of certain non-cash items and certain variable charges.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

- Adjusted EBITDA does not consider the impact of stock-based compensation expense or changes in the fair value of warrants;

- Adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us;

- Adjusted EBITDA does not reflect acquisition-related expenses;

- Adjusted EBITDA does not consider the impact of foreign exchange loss;

- Adjusted EBITDA does not reflect other non-operating expenses, net of other non-operating income, including net interest expense (income);

- Adjusted EBITDA does not reflect the impact of our contributions to Etsy.org; and

- other companies, including companies in our industry, may calculate Adjusted EBITDA differently, which reduces its usefulness as a comparative measure.

Because of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including net loss and our other GAAP results.

Etsy is not able, at this time, to provide GAAP targets for net income margin for 2016 and 2016-2018 because of the difficulty of estimating certain items that are excluded from non-GAAP adjusted EBITDA margin, including interest expense, net, provision for income taxes, depreciation and amortization, stock-based compensation expense, net unrealized loss on warrant and other liabilities, foreign exchange loss, other non-operating expense, net, contributions to Etsy.org and acquisition-related expenses, the effect of which may be significant.

| Reconciliation of Net Loss to Non-GAAP Adjusted EBITDA

(in thousands, unaudited) |

|

|

Three Months Ended

December 31, |

|

Year Ended

December 31, |

|

2014 |

|

2015 |

|

2014 |

|

2015 |

|

|

|

|

|

|

|

|

| Net loss |

$ |

(5,358) |

|

|

$ |

(4,232) |

|

|

$ |

(15,243) |

|

|

$ |

(54,063) |

|

| Excluding: |

|

|

|

|

|

|

|

| Interest and other non-operating expense, net |

224 |

|

|

263 |

|

|

549 |

|

|

1,202 |

|

| Provision for income taxes (1) |

3,103 |

|

|

6,340 |

|

|

4,983 |

|

|

26,069 |

|

| Depreciation and amortization |

4,731 |

|

|

4,509 |

|

|

17,223 |

|

|

18,550 |

|

| Stock-based compensation expense (2) |

1,708 |

|

|

2,422 |

|

|

5,920 |

|

|

8,981 |

|

| Stock-based compensation expense—acquisitions (2) |

2,334 |

|

|

(1,298) |

|

|

4,130 |

|

|

1,860 |

|

| Net unrealized loss (gain) on warrant and other liabilities |

172 |

|

|

(3) |

|

|

411 |

|

|

3,133 |

|

| Foreign exchange loss (3) |

2,035 |

|

|

6,048 |

|

|

3,049 |

|

|

21,775 |

|

| Acquisition-related expenses |

349 |

|

|

— |

|

|

2,059 |

|

|

— |

|

| Contribution to Etsy.org (4) |

— |

|

|

— |

|

|

— |

|

|

3,500 |

|

| Adjusted EBITDA |

$ |

9,298 |

|

|

$ |

14,049 |

|

|

$ |

23,081 |

|

|

$ |

31,007 |

|

(1) The provision for income taxes in the three and twelve months ended December 31, 2015 reflects the impact of the revised global corporate structure implemented on January 1, 2015.

(2) Total stock-based compensation expense included in the consolidated statements of operations is as follows (in thousands):

|

Three Months Ended

December 31, |

|

Year Ended

December 31, |

|

2014 |

|

2015 |

|

2014 |

|

2015 |

|

|

|

|

|

|

|

|

| Cost of revenue |

$ |

382 |

|

|

$ |

190 |

|

|

$ |

1,113 |

|

|

$ |

871 |

|

| Marketing |

85 |

|

|

211 |

|

|

216 |

|

|

560 |

|

| Product development |

466 |

|

|

879 |

|

|

1,461 |

|

|

2,860 |

|

| General and administrative |

3,109 |

|

|

(156) |

|

|

7,260 |

|

|

6,550 |

|

| Total stock-based compensation expense |

$ |

4,042 |

|

|

$ |

1,124 |

|

|

$ |

10,050 |

|

|

$ |

10,841 |

|

(3) The majority of the foreign exchange loss in the three and twelve months ended December 31, 2015 relates to intercompany debt incurred in connection with Etsy’s revised global corporate structure.

(4) Etsy made a one-time contribution of 188,235 shares of common stock totaling $3.2 million to Etsy.org during the first quarter of 2015. In addition, Etsy made a one-time cash contribution of$300,000 to Etsy.org during the second quarter of 2015.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/etsy-inc-reports-fourth-quarter-and-full-year-2015-financial-results-300224883.html

SOURCE Etsy, Inc.