President Donald Trump once again attacked Amazon and the Washington Post in some of his recent tweets.

In his latest Twitter rant against the company, the President railed that the Washington Post “has gone crazy against me” since Amazon lost their Internet Tax Case in the Supreme Court. He also jibed that the Washington Post is losing a fortune and described it as “nothing more than an expensive lobbyist for Amazon.”

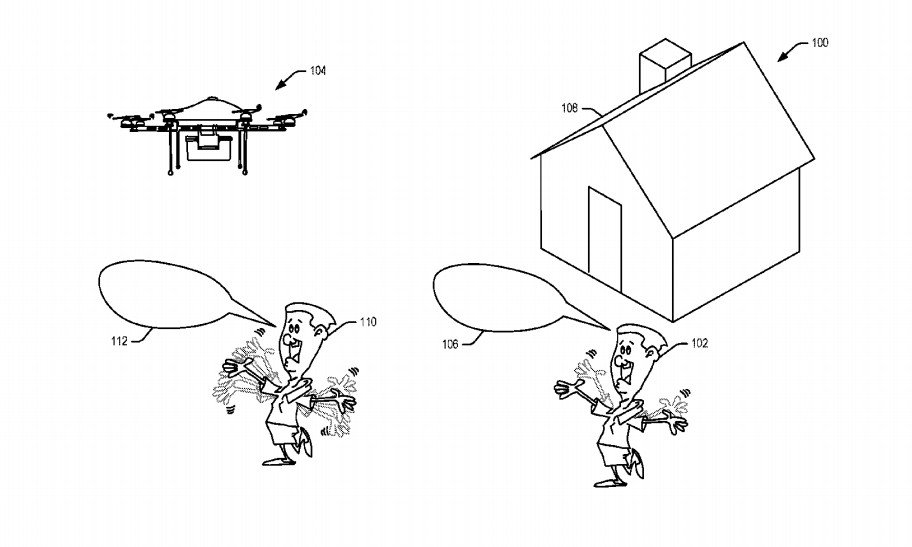

Trump also blasted Amazon for using the US Postal Service as a “delivery boy” for its packages at only “a fraction of real cost.”

The Amazon Washington Post has gone crazy against me ever since they lost the Internet Tax Case in the U.S. Supreme Court two months ago. Next up is the U.S. Post Office which they use, at a fraction of real cost, as their “delivery boy” for a BIG percentage of their packages….

— Donald J. Trump (@realDonaldTrump) July 23, 2018

….In my opinion the Washington Post is nothing more than an expensive (the paper loses a fortune) lobbyist for Amazon. Is it used as protection against antitrust claims which many feel should be brought?

— Donald J. Trump (@realDonaldTrump) July 23, 2018

Trump’s latest tirade came on the heels of a Washington Post’s report that was critical of how he handled North Korea. The paper claimed the president was frustrated with how long it was taking to see some progress after his talk with North Korea’s Kim Jong Un. Trump tweeted the country had not launched a rocket in 9 months and that “all of Asia is happy.” He also said what the “Fake News” is claiming is wrong and said that he was “very happy” with the way things with North Korea were proceeding.

Amazon’s shares dipped slightly after Trump’s tweets. However, the loss was minuscule when compared to the company’s 55 percent gains since the start of 2018. Trump’s tirade also did little to harm Jeff Bezos’ standing as the world’s richest man. The owner of Amazon and the Washington Post has a net worth amounting to about $150 billion.

This isn’t the first time that Trump attacked Bezos and Amazon regarding the e-retailer’s use of the USPS. In a tweet last December, Trump questioned why the USPS was charging the online store so little when they “Should be charging MUCH MORE!” He also tweeted in April that the Post Office was losing a fortune but that this will change.

It is true that the Post Office is losing money. The USPS reported a loss of $2.7 billion in 2017. Increasing the rates of shipping packages is one way to resolve the situation. However, the USPS’ main function is not to generate profit but to serve civilians. This is why the department’s shipping rates are very low.

Amazon also isn’t the only company using the US Postal Service. FedEx and UPS also drop off packages and utilizes the USPS as their “last mile” delivery. If the postal service does raise prices, it would affect all companies that ships packages, including small businesses that may find it difficult to cover increased shipping costs.

[Featured image via YouTube]